Our consultative approach results in the right solution every time.

Our leadership team is behind our solutions and services.

Learn about our open positions and how to join our team.

Reach out to a vehicle reimbursement expert or a support member.

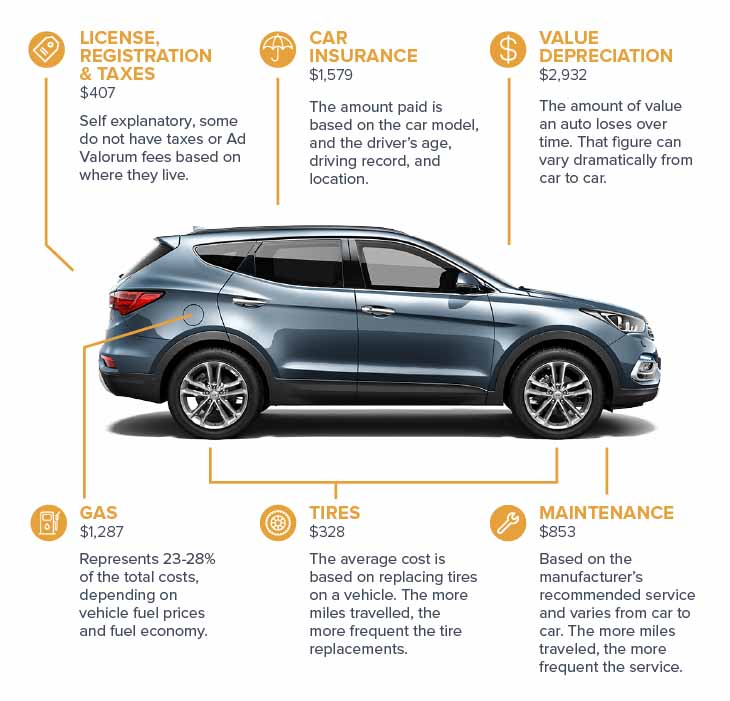

Customized vehicle reimbursement programs that provide equitable payments regardless of mileage and costs.

Ensure the safety of your organization & employees with insurance verification, MVR checks, the Safe Driver Program, and more.

Provide employees with the most flexible and customizable mileage tracking app that protects their privacy.

mBurse technology streamlines the reporting and approval process. You can manage your mileage approvals and reporting at your fingertips.

Get the benefits of a traditional car allowance (without the taxes). Save your company and people money.

Learn about our client's journey and road map to success with mBurse services.

Extensive research and visual guides on vehicle reimbursement solutions, mileage tracking, car allowance, risk, FAVR etc.

The most comprehensive guides on vehicle reimbursements, mileage tracking, and designing the best vehicle reimbursement solutions.

Find out how much you can save using our solutions.

Insights, updates, and the latest on vehicle reimbursements.