Client

Success

See how our clients have successfully streamlined mileage tracking, optimized FAVR plans, and improved company insurance management with our software.

Manufacturing

Sales

FAVR Program

mLog Tracking

Reset

Savings + Risk reduction with removal of company vehicles

Better reporting and visibility solve the cost of risk for a manufacturing representative company.

Read More

Sales organization reinvests tax waste to boost employee benefits

It was an easy move from paying a flat taxable car allowance to a tax-free reimbursement that allowed them to offer even more competitive benefits.

Read More

Food & Beverage Company Streamlines Process to Maximize Value

A company provided a mileage rate in addition to a fuel reimbursement and looked to streamline the process and stay in compliance.

Read More

.png?width=334&height=163&name=Merchandising%20company%20delivers%20larger%20benefit%20and%20saves%20money%20with%20mBurse%20solution%201%20(1).png)

Manufacturing company boosts employee benefits and generates ROI

Switching from a taxable car allowance to a non-taxable plan benefits both the company and its employees.

Read More

.png?width=334&height=163&name=Merchandising%20company%20delivers%20larger%20benefit%20and%20saves%20money%20with%20mBurse%20solution%201%20(2).png)

Sales Company drives mileage efficiency using mileage app and new rate

Switching from a standard mileage rate and adding mLog yields company savings through reduced mileage.

Read More

.png?width=334&height=163&name=Merchandising%20company%20delivers%20larger%20benefit%20and%20saves%20money%20with%20mBurse%20solution%201%20(9).png)

Medical Device company mirrors FAVR plan without the benefits

A small change to the reimbursement policy creates large benefits for the company and employees.

Read More

.png?width=334&height=163&name=Merchandising%20company%20delivers%20larger%20benefit%20and%20saves%20money%20with%20mBurse%20solution%201%20(4).png)

Manufacturers Firm creates employee benefit from inefficient payments

A company provided its employees with a car allowance, fuel, maintenance, and a set of tires. See how we helped.

Read More

.png?width=334&height=163&name=Merchandising%20company%20delivers%20larger%20benefit%20and%20saves%20money%20with%20mBurse%20solution%201%20(5).png)

Merchandisers Generate Savings and Benefits with Non-Taxable Car Allowance

When company fuel costs rise yet gas prices and company sales stay flat, a new reimbursement policy is required.

Read More

Oil and Gas company eliminates tax waste and gas card, reaps savings

Moving from a taxable car allowance and fuel cards yields cost controls, and improved employee benefits.

Read More

Tech company saves $112K annually after re-evaluating their fuel card

When company fuel costs rise but gas prices and sales do not, a new policy is required.

Read More

Medical device company saves $325K annually and boosts employee benefits

Switching from a taxable car allowance to a non-taxable plan yields benefits for both the company and its employees.

Read More

Coffee company saves $635K by transitioning from the IRS mileage rate

Reimbursing with the IRS mileage rate gets expensive fast. Adopting a smarter rate brings savings and scalability.

Read More

HVAC manufacturer saves $73K annually with CRM mileage tracking

Our Smart Mileage Rate and CRM mileage log combine to control costs and promote productivity.

Read More

Safety Equipment Company Achieves 237% ROI with Shift to FAVR Plan

When inflation outpaces a company mileage allowance, a fair, cost-effective solution is needed.

Read More

Manufacturing representative company transitions to FAVR to reduce Company Reduce Risk

A manufacturing representative company was providing company vehicles to approximately 100 employees. Employees received a fuel card and a liberal personal use policy that allowed them to use the vehicle for vacation. The company was self-insured to reduce the high premiums of purchasing insurance.

Before mBurse

Two major accidents and several fender benders occurred in 13 months, which triggered the company to reevaluate its policy. Three significant areas of concern emerged. The personal use chargeback policy was not enforced, there was no fuel card policy, and the client was not capturing business mileage to substantiate personal use.

The biggest concern was the personal use chargeback policy, which was directly connected to IRS compliance. Failure to substantiate business vs. personal use of the company vehicle or fuel card would be an auditable offense. The employees were “penciling” in what they felt was an adequate percentage of personal use, which hovered around 15% year over year. This was well below what the organization believed employees were actually driving since they had free reign to drive the vehicle on nights, weekends, and vacations.

The second concern was fuel card use. Employees faced no restrictions, and the costs for some of the employees well exceeded their actual business use. Without a policy for capturing mileage to assess the business and personal use of the vehicle and fuel, the company faced severe issues with IRS compliance and cost control.

Goals

- Provide an IRS-accountable plan to substantiate business use

- Create and enforce a personal use chargeback policy

- Reduce fuel costs from non-business use

- Right-size the fleet and eventually transition away from the fleet

mBurse Solutions

The client worked with mBurse to analyze the fleet costs and construct a plan to transition over three-quarters of the fleet from company vehicles to a FAVR plan over two years. The analysis phase helped reveal significant savings opportunities from creating a policy to govern fuel use and chargebacks on personal use.

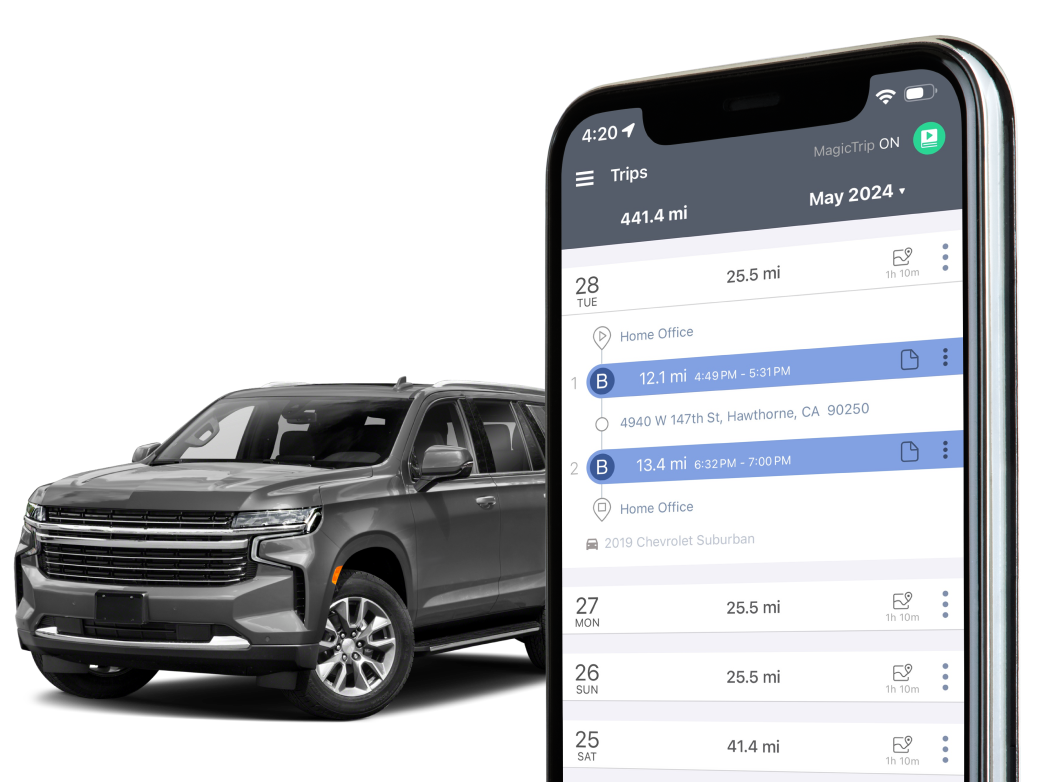

The client leaned on mBurse’s experience to help transition from company vehicles to a FAVR solution and to help bridge the gap from paying for expenses to having employees prepay expenses. All employees will use the mLog app to measure business mileage during the transition period and support the personal use chargeback policy.

Results

The mLog app gave the client valuable insights into personal and business use while transitioning from the company vehicles. There was much more personal use than the original self-reported 15%. The employees' average use of the company vehicle was almost 35% for personal use out of their total mileage.

The client also added guidelines on how much fuel employees could consume during the workweek and on weekends. This small change created significant fuel cost savings for the company.

Management that traveled over 5,000 business miles a year had the option of either the FAVR program or the company vehicle. All other reps were transitioned to FAVR, an IRS-accountable plan reimbursing vehicle expenses. There were soft savings from no longer insuring a large fleet and significant savings from removing the fuel card, since the FAVR plan included fuel costs in its rate.

Key Takeaway

Personal use is the Achilles heel of fleet programs and fuel cards. An organization that lacks visibility and enforces chargeback policies will experience severe cost overruns. A good mileage app like mLog can provide visibility and support policy enforcement.

While a company vehicle is a huge perk for employees, it is prohibitively expensive for many organizations in today's economy. Transitioning some or all of the fleet to a FAVR plan is prudent in an era of high vehicle costs and rising insurance premiums.

Sales organization receive a significant increase from transitioning a taxable event to a tax-free benefit.

A medium-sized company with approximately 80 employees spread across the U.S. was providing a car allowance to members of the sales and operations teams. These employees frequently met with prospects and clients and accrued significant monthly business mileage.

Before mBurse

The auto allowance policy had remained unreviewed for years. Originally a negotiation tool, the allowance amounts had grown out of control over time. Representatives’ roles and duties now required them to use their vehicles more frequently, necessitating an allowance aligned with their travel expense needs. However, some employees who received a larger allowance did not drive as many miles as others who received a lesser amount.

The car allowance needed to shift from negotiated compensation to a business tool. How could the organization change the allowance without upsetting employees or increasing costs? Recently, when adjusting the compensation plan, leadership was cautious about making too many changes at once that would impact employees’ pay.

They explored migrating to the IRS mileage rate, a non-taxed plan. However, while this option would offer some drivers more than their current taxable car allowance, others might not receive enough because they had smaller territories and drove less. Because the IRS rate does not track with short-term inflation, it can under-reimburse those in higher-cost areas.

Employees could end up padding their mileage to receive a more substantial reimbursement.

Goals

- Resize the allowance for employees based on costs and mileage

- Reinvest tax waste into better benefits for employees

- Make the reimbursement equitable for all employees

- Ensure the policy changes were not disruptive to the team

Company Savings

mBurse Solutions

The client partnered with mBurse to review and analyze all employees’ allowances and projected mileage. We proposed a tax-free allowance plan to address geographic cost variances and eliminate inequities from mileage differences. mBurse created a FAVR reimbursement report showing the reimbursement amounts each employee would receive and the cost impact to the company.

Based on the mBurse recommendation, the group was separated by needs. Two reimbursement tiers were created to ensure everyone received an appropriate amount. We could leverage the tax waste built into their old program to help equalize employee differences and provide better overall benefits.

Results

We achieved the biggest goal: standardizing the reimbursement and providing employees with the correct reimbursement for their needs. Everyone received more than the previous policy. By reallocating the tax waste and shading this to the employees, employees averaged a 19% increase from the flat taxable car allowance.

The client was also able to provide a cost-neutral program that generated minor savings in net

mBurse fees.

Key Takeaway

An organization must prioritize solving car allowance inequities. Making a change now rather than waiting can save a lot of money over time. Leveraging tax waste to offset company costs and provide value to employees creates win-win solutions.

It is also critical to use data for accurate reimbursements. FAVR programs are designed to use data to provide accurate payments to employees who live in high-cost and low-cost areas and drive high-low-mileage vehicles.

Food and Beverage Company Streamlines their Policy to Maximum Benefits

A food and beverage company was paying 18 employees the IRS mileage rate while also paying for fuel.

Before mBurse

The client provided a mileage rate and fuel reimbursements for over eight years. In the previous six months, the fuel receipts amounted to three times the mileage

reimbursement for the team. The company sought ways to reduce costs while

gaining better visibility into individual trips.

Employees were self-reporting the total monthly mileage, which left room for inaccurate reports. The client also learned that they should have kept better records and charged back for the personal fuel the employees were consuming. Instead, the employees only turned in the fuel receipts for the month.

The company came to mBurse looking for a way to comply with travel and expense policies and measure personal vs. business fuel.

Goals

- Establish a fair travel and expense policy

- Comply with IRS and State regulations

- Get help with the change management portion of transitioning to a new policy

- Provide a data-based reimbursement for all employees

Company Savings

mBurse Solutions

In 2022, the company partnered with mBurse to comply with the personal use chargeback for fuel reimbursement and move away from self-reporting mileage.

Due to automation and higher visibility into expenses and mileage, reported mileage and fuel consumed were significantly reduced by almost 61%! However, some employees complained that the new policy needed more relaxed.

In early 2023, after management learned more about fixed and variable reimbursement (FAVR) benefits, they felt it would be a happy medium to provide more value to the employees while retaining the advantages of structure and automation.

Management designed a program that "split the efficiency" differently to provide more benefits to the employees. They further made slight adjustments throughout the year to continue improving employee satisfaction.

Results

Even though the client sought policy consulting and a way to track mileage, they learned about FAVR and transitioned the team to a FAVR plan. This was the most equitable solution for the company and the employees.

Quite a few of the employees’ fuel costs could be explained based on the vehicle they owned

(less efficient) or on their reporting method. A more standardized approach was needed. The

company wanted better visibility into mileage and expenses and felt FAVR was the best route.

After implementing the FAVR program, fuel reimbursement costs flattened considerably. Because fuel was incorporated into the FAVR payments, the company didn’t need to address fuel overreporting or take additional steps to ensure compliance. The IRS-compliant mileage tracking gave the company productivity insights without violating employees’ privacy.

Key Takeaway

You can’t manage what you can’t see. Self-reported mileage summaries generally will

encourage over-reporting, which increases costs. Providing a fuel reimbursement is easy and

sounds great, but it comes with a great responsibility to monitor costs. A FAVR policy controls costs and ensures IRS compliance.

Independent Distributor Reduces Reported Mileage By 38%

This independent distributor for several large manufacturers fields approximately 48 sales reps who operate primarily in the northeastern United States. Up until 2015, reps were reimbursed using the IRS mileage rate.

Before mburse

After years of reimbursing at the IRS mileage rate, in 2015 the company reduced its mileage rate to control costs; however, reported mileage increased, increasing the costs.

Two situations complicated the matter. First, confusion arose over the definition of business mileage. The company had always designated each rep's first and last trip of the day as a commuter, or personal, trip. (All of the reps were based from home.) This classification differed from IRS standards.

Second, a sales rep caused an accident during work hours, resulting in extensive damage to the other vehicle. Because the rep was underinsured, the company had to pay part of the costs. Company policy required employees to maintain the state minimum car insurance. However, the Massachusetts minimum for property damage was only $5,000, insufficient in this case.

Goals

- Properly and equitably reimburse employees

- Control company costs

- Reduce the company risk profile

- Minimize cost increase to 21% over current spending

- Develop a clearer business mileage policy

Mileage Reduction

Results

The outcome laid all concerns to rest. In the first year, reported mileage dropped by 38%, from an average of 2,250 miles/month to 1,395 miles/month.

Overall costs decreased by 7.6% annually. The mileage app provided new insights into business travel ROI and productivity. Management could rest assured that their new reimbursement and risk management policies offered greater protection to the organization.

Key Takeaway

A clearly defined reimbursement policy using objective data to define reimbursement rates will yield impressive results, especially in employee-friendly states. Different employees should receive different reimbursements based on their territory sizes (mileage) and geographical costs.

An equitable reimbursement policy will decrease company costs by decreasing over-reported mileage, especially when paired with an automated mileage tracking app.

.png?width=334&height=163&name=Merchandising%20company%20delivers%20larger%20benefit%20and%20saves%20money%20with%20mBurse%20solution%201%20(2).png)

Educational Sales Company Reduces Mileage Reports by 39%

An educational sales company was fielding 35 drivers. Each driver was reimbursed for vehicle expenses using a company-calculated mileage rate that was lower than the IRS standard business mileage rate.

Before mBurse

After paying the IRS mileage rate for several years, company leadership decided to develop their own more modest mileage rate. This decision was based on an attempt to the control costs of their high-mileage travelers. After a couple of years of this company-calculated mileage rate, costs did decrease, but not significantly. Upon further review, leadership concluded that self-reporting of business mileage was limiting any reduction in costs.

The company also had concerns about employees that resided in employee-friendly states with expense indemnification codes, specifically California, Illinois, and Massachusetts. In these states, the labor codes required employers to be able to demonstrate that their reimbursement rate fully covered each employee’s costs or be exposed to civil suits.

Goals

- Develop an optimized reimbursement rate that complied with labor codes

- Adopt a mileage capture model that did not rely on self-reporting

- Ensure long-term cost controls for business vehicle reimbursements

Annual Savings

mBurse Solutions

The company implemented a FAVR program to ensure they had a defensible reimbursement policy with a standardized methodology to ensure accuracy. The fixed and variable rate reimbursement model (FAVR) provides a transparent rate to employees that adjusts as costs increase or decrease over time, preventing both cost overruns and labor code violations.

The team also adopted the mLog mileage app to capture business mileage without self-reporting. This real-time mileage tracking tool eliminated after-the-fact estimates of mileage as well as padding of reported mileage. Privacy concerns were addressed by mLog’s features that prevent employers from knowing employees’ real-time locations and that only report business mileage, not personal trips.

Results

The program overall was cost neutral, generating some savings. The company gained peace of mind that their policy was structured well and that employees received a fair and accurate reimbursement that helped control reimbursement costs.

The company also reduced the overall mileage by 39%, which resulted in a 5.1% cost reduction (after subtracting mBurse fees). Since some employees lived in higher-cost areas, the transition only generated $9.5K of annual savings. But the company improved its policy and automated mileage capture, making the employees accountable for business mileage.

With long-term cost controls in place, the new program was sustainable while providing defensible reimbursements to employees in states with strict labor laws.

Key Takeaway

Self-reported mileage, whether on a company spreadsheet or in an expensing system, will generally result in over-reporting of mileage. A mileage reimbursement rate allows employees to increase their pay simply by driving or reporting high mileage amounts, whether or not they are actually contributing greater output. An accurate mileage tracking app like mLog is the best way to eliminate this problem.

Medical Device Company Saves 260K with FAVR Vehicle Plan

A medical device company with 64 employees was paying both a car allowance and a mileage reimbursement. The car allowance payments were fully taxable, while the mileage reimbursements were delivered tax-free. This plan essentially mirrored a FAVR plan, but without the full tax savings.

Before mBurse

Management realized that the combination of a taxable car allowance and a mileage reimbursement was over-reimbursing many of their employees. Unlike the many organizations that make the mistake of ignoring their car allowance amount for years at a time, this company had made a commitment to increase the car allowance every three years, a different kind of mistake. In addition, employees had gradually been increasing their self-reported mileage on the spreadsheet log.

Business vehicle costs were increasing unsustainably, and the company needed to do something about it. At the same time, they knew employees would object to changes that eliminated the over-reimbursements if it meant less take-home pay. How would they reign in costs while preserving employee trust?

Goals

- Streamline the car allowance and eliminate tax liability

- Ensure that car reimbursements tracked with actual costs

- Create a cost-neutral vehicle reimbursement program

mBurse Solutions

All of this company’s problems stemmed from essentially operating a fixed and variable rate reimbursement plan (aka a FAVR plan) without the tools necessary to do so. Our solution was simple – adopt a FAVR reimbursement plan using the appropriate tools.

A genuine FAVR program pays a non-taxable allowance plus a non-taxable mileage rate, both derived from geographic cost data and both responsive to changes in costs over time. The first step for the medical device company was to follow the IRS guidelines necessary to convert the fixed monthly payments (the car allowance) to non-taxable payments. It turns out that their allowance amount was 40% higher than industry standards and 30% higher than actual fixed vehicle costs.

The second step was to adjust the mileage rate to rise and fall with variable costs like gas prices in each employee’s region. Finally, the company adopted our mileage tracking app, mLog, eliminating the self-reported mileage on the company spreadsheet and resulting in more accurate mileage reports.

Results

The company’s net savings of nearly $260,000 resulted primarily from eliminating taxes and reducing over-reports in mileage. Because the company elected to reinvest the tax waste into its employees’ benefits, the average employee benefit saw a slight increase rather than a decrease, mitigating concerns about savings coming at their expense.

The drivers actually could have enjoyed a higher relative benefit, but previous mileage padding had already inflated their reimbursements. This robust but sustainable car allowance positioned the company to attract and retain top talent.

Key Takeaway

The value of eliminating taxes on a car allowance cannot be overstated. This is the single most effective way to rein in costs while sustainably offering a competitive employee benefit. But in order to effectively operate a FAVR reimbursement plan, it is essential to also adopt an accurate, user-friendly mileage log that does not rely on self-reporting.

Manufacturers’ Rep Firm Gains 373% ROI in First Year of FAVR Program

A manufacturing representative company was paying its employees a flat taxable car allowance while also reimbursing fuel and providing maintenance with a free set of tires every 18 months. Approximately 60 drivers were receiving these benefits.

Before mBurse

This client had been paying the same taxable car allowance amount for several years. Over time, concerns that the car allowance was not enough resulted in the addition of the various reimbursable items – fuel, maintenance, and tires. Adding these benefits created a complicated system that grew more costly as time passed, raising questions about sustainability and scalability.

IRS compliance had also become a problem. The organization did not substantiate the business use of the fuel, maintenance, and tires. Nor did they measure the personal use and chargeback employees. Both business substantiation via a qualifying mileage log and personal use chargebacks are required to keep reimbursable items free of tax liability. Failing to follow these guidelines had left the company exposed in the event of an audit.

The company did withhold taxes from the car allowance in compliance with IRS rules. However, the system of business reimbursement was inefficient. Both the company and employees were paying taxes on an expense that could be treated as a reimbursement if properly substantiated, on top of the other reimbursements that were not being properly substantiated.

Goals

- Provide an IRS-accountable plan for vehicle reimbursements

- Remove tax waste through a fully non-taxable program

- Tighten up the policy with a more efficient structure

- Stop over-reimbursing and optimize the car allowance

mBurse Solutions

When the client decided to partner with mBurse, we immediately proposed a FAVR program. The fixed and variable rate (FAVR) reimbursement model was perfectly suited to solve the majority of the issues. One single plan could right-size the car allowance while keeping it and the other reimbursements non-taxable.

Because an IRS-complaint FAVR plan already takes into account the costs of fuel, maintenance, and tires, these reimbursements were eliminated as separate benefits. These expenses would now be reimbursed through a variable mileage rate in addition to the optimized monthly allowance.

The mBurse mileage app, mLog, would allow the organization to properly measure and substantiate the business use of the vehicle and associated costs, keeping the entire program IRS accountable. As part of the process, we were able to calculate a transparent reimbursement rate for each driver based on their costs within their driving territories.

Company Savings

Results

Adopting a FAVR program allowed the client to reallocate money into a sustainable reimbursement that remained robust for employees. By eliminating taxes from the car allowance, they were able to pay an optimal amount while saving money. They also had been slightly over-reimbursing the employees by paying too much for maintenance and not measuring the business vs. personal use. The new program eliminated this over-payment by optimizing the reimbursements.

Savings on fuel costs also came because FAVR incorporates fuel into the mileage rate. Accurately measuring the business use and eliminating paying for personal use combined to provide further savings. Overall, employees on average actually reaped a modest increase in their benefit because the elimination of the taxes on the car allowance more than covered the removal of the over-payments related to maintenance and fuel.

Key Takeaway

It is vital to substantiate the business use of a personal vehicle for work. By investing in the right tools and procedures, an organization can eliminate wasteful taxes on car allowances while also staying compliant with reimbursement of expenses.

A FAVR reimbursement program combines a non-taxable allowance with a geographically sensitive and transparent reimbursement rate. Adding reimbursements on top of a standard car allowance, on the other hand, is destined to create costly complications. FAVR programs are designed to accomplish the same goals in an IRS-accountable and streamlined manner.

Merchandising company saves $22K, boosts employees’ car allowance by 48%

A merchandising company employed approximately 65 sales and merchandisers that visited local chains. The employees operated all over the contiguous United States using personal vehicles to carry out their jobs. Each received a $475.00/month car allowance that was treated as taxable income.

Before mBurse

Voluntary turnover rates hovered around 48% over a 3-year period. The high turnover rates contributed to higher costs associated with hiring replacements as well as lower productivity. Turnover rates also impacted employee morale. When an employee would leave, it would put pressure on the existing employees to work more and drive more.

As a result, multiple employees complained that the car allowance was not enough to cover their travel costs. Different employees experienced different costs but received the same car allowance. The car allowance had been established 15 years earlier when $475/month was considered robust. But after taxes, the average take-home from the car allowance was around $300/month. Times had changed, and the company needed to take action to address employee concerns.

Goals

- Find the optimal car allowance amount using industry baselines

- Increase employees’ net average car allowance significantly above $300/month

- Minimize cost increase to 21% over current spending

mBurse Solutions

The company partnered with mBurse to design and implement a new car allowance program. With employees fearful that any change might negatively impact their income or time, management initially was leaning toward simply providing all employees with an additional $100/month of taxable car allowance.

After examining the current situation, however, mBurse proposed a FAVR program. This non-taxable reimbursement would combine a fixed allowance amount with a variable mileage rate. Each employee would receive a take-home amount appropriate to his or her travel costs. This was the most equitable solution for all employees and would achieve all of management’s objectives.

As the company learned more about the FAVR program, they could see that the increased net pay to employees would be funded by redirecting the tax waste from the previous car allowance. This would offset any costs to the company while boosting morale.

Management initially expressed concern that the FAVR program would require drivers to use a mileage log. They did not want their employees spending their time logging mileage. However, the mBurse mileage app made a laborious task easy, leading to full implementation.

Company Savings

Results

After the first year the company saw remarkable results. Overall costs decreased by 5.29%. More impressive was the drop in employee turnover by 22%. The client generated ROI in less than 7 months of service. The first-year ROI amounted to 90.22%.

Mileage capture not only took less time than expected but also provided helpful insight into different employees’ territory sizes to minimize overlap and increase productivity. A vast majority of the merchandisers used the built-in route planning features in the mBurse mileage app to plan their week.

The employees enjoyed a significant increase in their net allowance amount. Overall there was an average annual increase of $1,769, which helped lower the turnover and thereby decrease the territory sizes.

Key Takeaway

Pay better and pay differently—remove the tax waste, and right-size the reimbursement. It’s not a secret that many employees view pay as a key indicator of their growth.

As soon as an employee struggles to pay bills, they will immediately start to wonder if this job is for them. As an alternative to raising salaries, switch to a non-taxable car allowance as a means to boost benefits.

Oil and gas company saves $165K, boosts employees’ car allowance by 35%

An oil and gas company was paying approximately 250 employees a taxable car allowance that had remained the same amount for many years. In addition, the company provided a fuel card to employees.

Before mBurse

Between providing a car allowance and a fuel card for so many employees, the oil and gas company struggled to control costs. They faced a scalability and sustainability problem as the company grew and costs ballooned.

With a portion of their car allowance diverted to taxes, employees relied on the fuel card to offset vehicle costs. Because the allowance was not adjusted for geographically-sensitive costs, some employees experienced higher costs than others. Over time, though the car allowance did not increase, company costs climbed as employees used the fuel card more liberally. The company did not require employees to report personal use of fuel (which violated IRS regulations).

Goals

- Adopt a more optimal and cost-effective car allowance

- Eliminate fuel cost overruns and gain sufficient visibility into fuel usage

- Comply with IRS tax regulations while eliminating tax waste

Company Savings

mBurse Solutions

After partnering the mBurse, the oil and gas company adopted a non-taxable car allowance. By eliminating the large chunk of expenditure that went to the government instead of employees, the organization freed up resources to boost the car allowance to more accurately reflect the employees’ vehicle cost needs.

mBurse also helped the company craft a new set of policies surrounding fuel consumption. By implementing our fuel consumption tools, they achieved compliance with IRS regulations and charged back employees for personal usage of fuel.

Results

In the first year, the oil and gas company netted $165,000 in savings. By eliminating taxes on the car allowance along with the expense of personal fuel usage, the organization was able to increase employees’ net car allowance by an average of 35%.

The car allowance now sufficiently reimbursed vehicle expenses, reducing the pressure employees felt to rely on the fuel card to offset unreimbursed expenses.

Key Takeaway

To provide a robust car allowance while controlling company costs, adopt a non-taxable plan. The savings in eliminated tax waste will more than pay for administrative costs, and it is possible to provide a better employee benefit while paying less overall.

It is also vital to avoid paying for personal fuel usage, either by eliminating the company fuel card or putting in place fuel consumption tools that allow for personal use chargebacks.

Tech company saves $112K annually after replacing their fuel card

A technology company was paying its sales team a $600/month taxable car allowance. In addition to the allowance, these employees received a fuel card.

Before mBurse

Over a period of 18 months, the costs of the fuel card had steadily outpaced gas prices. The company was facing a 135% increase in annual costs with out a similar increase in sales.

To reduce overuse of the fuel card, management introduced a new policy that prohibited the use of the fuel card on Fridays and Mondays. This new policy reduced costs by about 24%. In order to explore further ways to reduce expenses, management contracted with mBurse to develop alternatives to their current car allowance and fuel card policy.

Goals

- Eliminate fuel cost overruns

- Eliminate taxes on the car allowance

- Adopt a scalable, cost-effective vehicle policy

mBurse Solutions

mBurse analysis found that one group of 10 employees was responsible for 50% of fuel card use. This group of employees drove full-size SUVs, while the other 40 employees drove a range of compact to full-size vehicles. Additionally, our analysis found that the car allowance was costing the tech company more than $166K in taxes each year.

In the end, tech company adopted a non-taxable car allowance combined with a standardized cents-per-mile reimbursement. This new policy ensured that the employees' choices in vehicles no longer affected company costs, which led to a fairer distribution of reimbursement payments. Each employee would be reimbursed based on the expected expense of one standard, appropriate vehicle, driven a certain number of miles.

Additionally, adopting a non-taxable car allowance eliminated $278/month in tax waste per employee. By removing the government as a recipient of these payments, the new policy reduced overall costs while boosting benefits to the employees.

Company Savings

Results

In the first year, the tech company netted $112,000 in savings. By eliminating taxes along with the expense of directly paying for fuel, the organization was able to increase employees’ net benefit by an average of 10.43%.

Outsourcing the car allowance program to mBurse brought significance savings, which the organization largely reinvested in its employees. The overall return on investment was a whopping 624%. The new program was also scalable enough to set a foundation for long-term growth.

Key Takeaway

Businesses often issue a fuel card to help employees afford rising gas prices. However, this approach drives up costs and creates inequities based on employees’ vehicle choices and driving habits.

A non-taxable car allowance combined with a cents-per-mile reimbursement can address employee needs more equitably while controlling costs. This type of program is called a FAVR plan.

Medical device company saves $325K annually and boosts employee benefits

A pharmaceutical and medicine manufacturing company in the Southwest paid 150 employees each a $750 monthly taxable auto allowance. Employees were spread all over the country, and none of them did a large amount of traveling for their jobs.

Before mBurse

The pharmaceutical company had some new drugs that had become held up within the FDA approval process. While waiting for them to go through, it became necessary to reduce costs. Their car allowance policy became one of the first areas they looked to cut costs.

Rather than slashing their car allowance amount, they needed to eliminate the taxes on the payment. Because employees were scattered around the country, the organization needed to pay geographically sensitive reimbursements. A mileage reimbursement plan would not work due to the employees’ relatively small territory sizes. They instead needed a plan that would work for drivers with low monthly mileage amounts.

Goals

- Reduce the cost of the car allowance

- Find a flexible reimbursement method

- Retain valuable employees

Company Savings

mBurse Solutions

mBurse proposed a FAVR program to replace the taxable car allowance. This non-taxable reimbursement would combine a fixed allowance amount with a variable mileage rate, both sensitive to the costs of each employee's garage zip code. Each employee would receive an individualized reimbursement suitable for his or her travel costs. This solution would work for employees in every part of the country, even if they did not drive very much.

The mBurse plan provided both savings to the company and an increase in the net benefit for employees now that taxes were eliminated. Furthermore, they liked the fact that management could adjust the plan to deliver even greater benefits once their drugs were approved and the company started performing better.

They also enjoyed the new tools provided by the mBurse reimbursement software. The dashboard generated reports that brought visibility to sales calls. These reports provided opportunities for sales coaching and development. The reimbursement system also helped to maximize time management and efficiency, saving even more money in the long run.

Results

The first year brought results. The medical company realized a 25% decrease in costs while delivering a 27% increase to employees using the mBurse FAVR plan.

Mileage capture took less time than expected. Using the mLog mileage app provided insight into employees’ sales calls and helped increase productivity.

Key Takeaway

For organizations that pay a car allowance, removing taxes is the easiest way to reduce costs. This step also boosts employees' benefits when they share in the savings from money no longer going to taxes.

Partnering with mBurse gives an organization access to both a flexible reimbursement method and software that can automate reimbursements and help boost sales productivity.

Coffee company saves $635K after transition from IRS rate

A large nationwide coffee company was paying the IRS mileage rate to reimburse employees for travel. When the IRS lowered the rate, the company's reimbursement payments unexpectedly increased, leading to a need for consultation.

Before mBurse

When the IRS business mileage rate decreased, the coffee company assumed its annual costs for business travel would also decrease. Instead however, they increased by more than $800 thousand from the previous year.

Management didn’t understand the connection between the lower rate and higher costs, so they proposed reducing their mileage rate to a lower in-house rate. This lower rate would reduce costs but also upset employees. The company instead sought professional consultation to find equitable alternatives.

Goals

- Control business travel costs

- Adopt an equitable reimbursement rate

- Retain valuable employees

Annual Savings

mBurse Solutions

mBurse analysis discovered an explanation for the increased costs: when fuel prices increased, recorded business mileage also increased. mBurse recommended our “Smart” Mileage Rate to assist with controlling costs. Unlike the nationwide IRS rate, the “Smart” Mileage Rate is based on a variety of factors: fuel efficiency of a mid-sized vehicle, current fuel prices, and ownership costs within each employee’s territory.

After adopting the "Smart" Mileage Rate, the company's reimbursements increased and decreased each month based on the movement of fuel prices. This variable rate plan offered a standardized solution that was fair and equitable, with complete transparency to the employees.

Results

mBurse’s “Smart” Mileage Rate saved the company more than $635K. The cost savings were immediate. Within 60 days, there was a significant reduction in the number of business miles recorded. Within 90 days, the company noted a 20% reduction in reported mileage.

While employees were not initially thrilled with the new policy, they eventually recognized that the reimbursement was fair and understood the reason for the policy. Each employee received their own rate schedule defining exactly what they were being reimbursed for. This fair and transparent approach allowed the organization to retain valuable employees while reining in costs.

Key Takeaway

The IRS mileage rate is based on average costs for motorists and may not fit every employee in a large organization. Because it is updated annually, the rate does not rise and fall with gas prices.

Adopting a more responsive rate is a fairer approach to both the company and the employees. The transparency and fairness offered by a "Smart" Mileage Rate helps retain employees while controlling costs.

HVAC manufacturer saves 73K annually with CRM mileage tracking

A heating and air distribution company in the Southeast had been paying its employees 25 cents per mile for the previous 10 years. The sales team was logging 2,800 miles per month but sales were flat.

Before mBurse

Management was exploring innovative business practices to increase revenue and reduce costs. The sales team was reporting 2,800 miles a month, an increase over previous years, yet their productivity had decreased. Costs were growing unmanageable. The company had not been able to give salary increases to the sales team for two years.

Further complicating matters was a low CRM adoption rate. The company had invested in the Salesforce.com platform, but only around half of the sales reps were using it. This rendered accurate analysis and projections of sales activity nearly impossible.

Because of new competitors moving in their region, business practices had to change, so they called mBurse.

Goals

- Cut costs while retaining employees

- Increase CRM adoption and sales productivity

- Ensure long-term cost controls for business vehicle reimbursements

Annual Savings

mBurse Solutions

To control costs and to boost productivity, mBurse recommended our Smart Mileage Rate along our mileage app TUrnsignal. This mobile app is designed to integrate with the Salesforce CRM. Customizable to actual employee needs, the Smart Mileage Rate would follow a specific formula to calculate each employee’s rate. Reimbursements would increase and decrease each month based on fuel prices for each employee.

Next, we installed TUrnsignal with their Salesforce subscription to track mileage. This made mileage capture and calculation easier while keeping everything in Salesforce like the company wanted. The new process would save time and mileage while ensuring CRM adoption. If employees did not use the CRM-integrated mileage app, they would not be reimbursed for their mileage.

Results

The new policy provided an innovative option while combining administrative tasks. This developed into a competitive advantage over others in the industry. Implementing a cost-neutral, non-taxed auto reimbursement policy reduced costs by more than $73.6K annually (a 15.15% cost reduction) after redistribution of savings and fees. Within the first year of implementation, reported mileage dropped from an average of 2,800 miles per month to 1,651 miles per month.

Using the Smart Mileage Rate, the average employee rate increased from .25/mile to .36/mile, but the average reimbursement decreased from $700/month to $594/ month. Increased accuracy of reporting via the TUrnsignal app had decreased the reporting of “empty" miles. TUrnsignal also made measuring productivity and business travel ROI significantly easier. Managers were now able to coach and develop underperforming reps, and recruiters were able to develop a profile for successful candidates based on the top performers’ activities.

With mileage capture now mostly automated, employees gained an extra eight hours per month to spend on more productive activities. Both morale and productivity increased, and in six months sales had increased by 19%.

Key Takeaway

Self-reported mileage will lead to over-reporting of mileage, especially when gas prices rise. Adopting a mileage rate that tracks with gas prices reduces the incentive to report inflated mileage.

A mileage tracking app like TUrnsignal takes away an administrative task and gives back time to employees. At the same time CRM integration allows increased visibility into sales productivity. Mileage reports will decrease even as sales increase.

Safety equipment company achieves 237% ROI with a FAVR plan

A national organization that sold safety equipment was providing a mileage allowance to 85 sales representatives across the country.

Before mBurse

Questions had risen regarding whether inflation had outpaced the company’s 10-year-old mileage allowance policy when several reps complained that it was not enough. The company wanted a review to make sure they were providing a fair mileage allowance.

There were also concerns that the mileage allowance wouldn’t comply with certain labor codes. Since there wasn’t any substantiation of costs, employees that worked in California, Illinois, and Massachusetts might leave the company exposed.

The company contemplated adding an additional $100/month to each employee’s mileage allowance, but that would increase costs over $100K annually without definitively solving the problems of talent attraction, compliance with labor codes, and avoiding overpayments and underpayments.

Goals

- Continue providing a tax-free vehicle reimbursement

- Ensure the reimbursement tracked with current costs

- Remain compliant with labor code laws

mBurse Solutions

The client initially decided to partner with mBurse to receive reimbursement data that was reflective of the costs their employees experienced. The reimbursement data signaled that not all employees were being reimbursed equitably. Any employees that drove under the mileage threshold for a tax-free mileage allowance would experience tax liability, which could encourage falsifying mileage records to remain tax free.

As a result, the client adopted a FAVR plan so that all employees, no matter their location or miles driven, would receive a payment that reflected their costs. Implementing a FAVR policy also ensured compliance in states with an expense indemnification law. The FAVR program takes a standardized approach to ensure every employee is fairly reimbursed.

Results

Originally the goal was to improve the existing mileage allowance, which eventually shifted to providing a professional reimbursement policy that would scale to mileage and costs. The reinvestment into a FAVR plan rather than increasing the mileage allowance worked out for both the company and the employees—especially the lower mileage travelers, whose tax liability was removed.

Employees easily adapted, as they now received a car allowance plus a mileage rate. The high mileage drivers were happy to receive more reimbursement dollars, since their mileage had exceeded the mileage allowance, and they could not write off the unreimbursed expense.

The Numbers

- $52,325 total annual savings

- 90% reduction in tax liability

- 237% annual ROI

Key Concept

A mileage allowance is an example of a good idea with unforeseen consequences. Different employees drive different amounts and interact with catch-all policies in different ways. By offering reimbursements customized to different employee needs, you can eliminate tax liability, ensure all costs are covered, and shape employee behavior in productive ways.

Interested in our latest developments?