Everything You Need to Know about Mileage Reimbursements

Our definitive guide to mileage reimbursements, the IRS mileage rate, and business mileage expenses in 2025

Let’s start with a quiz: five questions about mileage reimbursements. It’s ok if you don’t know the answers. As you read this guide, you’ll find the answers woven throughout.

How much do you know about mileage reimbursements?

If your organization employs people who use a personal vehicle for work, you have a mobile workforce. Mobile workers make sales calls, manage accounts, provide training, attend conferences – and more. These employees should be compensated for the business use of their personal vehicle.

Your organization may pay a cents-per-mile reimbursement such as the IRS mileage rate or a monthly car allowance. If you’re paying a car allowance, read on to learn about mileage reimbursement, or check out our ultimate guide to car allowances.

5 Questions to Ask about Business Mileage Reimbursements

- How did you choose the mileage rate or reimbursement amount?

- Does the reimbursement cover the expenses of every employee?

- How long has it been since you last reviewed your plan?

- Is your mileage reimbursement plan taxable?

- If so, are you properly withholding taxes?

Obtaining the answers takes time. As a result, many organizations avoid reviewing their business mileage program.

It’s easy to just pay the federal mileage rate and leave it at that. But what if we told you that your mileage reimbursement may be costing the company in small ways that add up?

Mileage Reimbursement Policy Goals:

- Increase cost-effectiveness and efficiency.

- Ensure fair treatment of employees.

- Attract and retain valuable workers.

- Reduce risks associated with employee drivers.

Taking the time to review and optimize a business vehicle policy will pay dividends. If your mileage reimbursement program can support these four goals, the time will be worth it.

Read on for key insights into developing your 2025 business mileage reimbursement plan.

- Chapter 1 What mileage reimbursement covers

- Chapter 2 Is your mileage rate taxable?

- Chapter 3 The best mileage reimbursement for your company

- Chapter 4 Mileage reimbursement challenges

- Chapter 5 Hidden costs of car reimbursements

- Chapter 6 IRS tax rules for car reimbursements

- Chapter 7 Calculating your optimal mileage rate

- Chapter 8 Conclusion: Act now

What costs a mileage reimbursement covers

A lot of businesses just want to answer a single question:

How much is mileage reimbursement in 2025?

Many will say the IRS standard business rate, or federal mileage rate – 70 cents per mile. But that response misunderstands employee vehicle reimbursement. To determine an appropriate reimbursement rate, you need to know what expenses a mileage reimbursement actually covers.

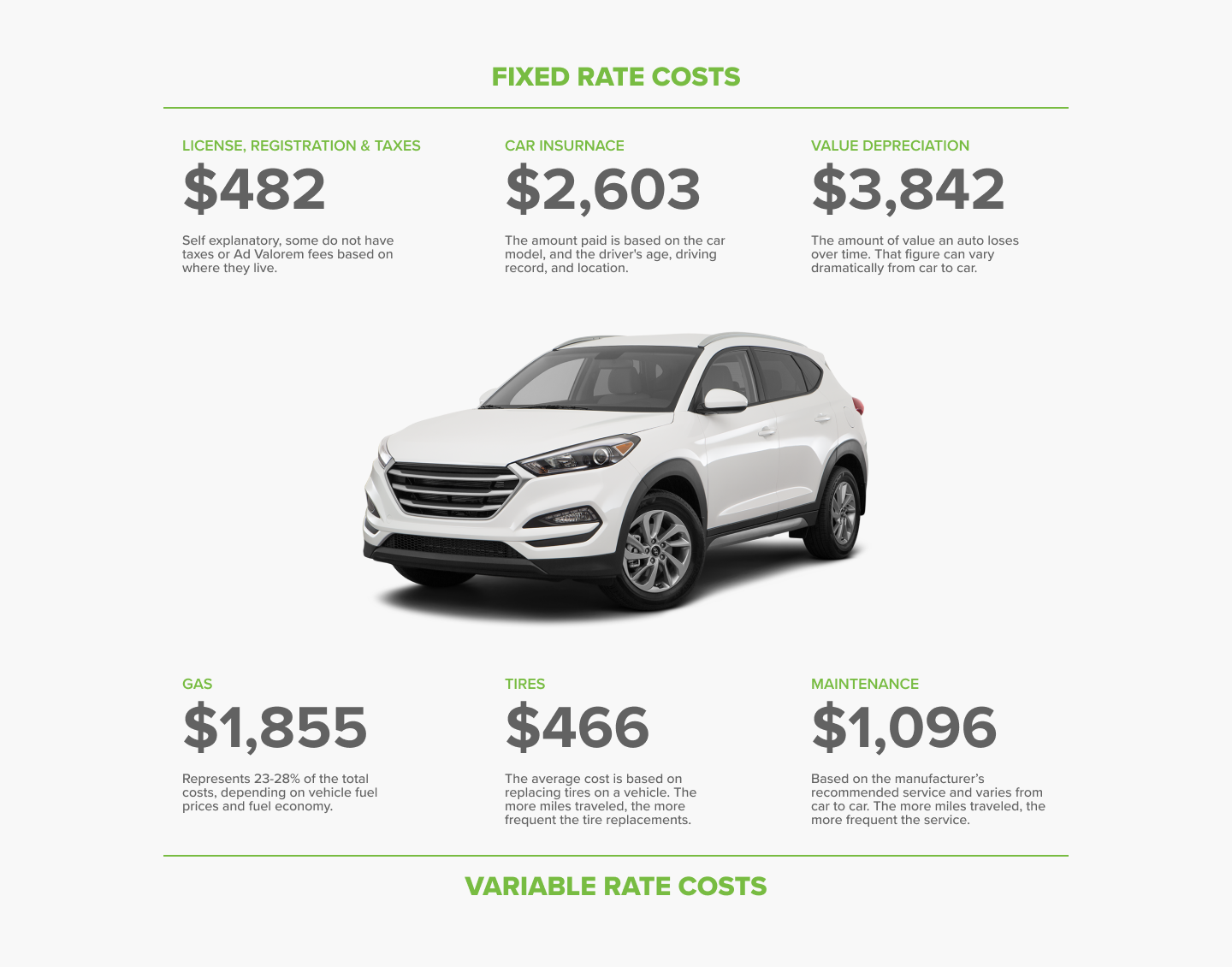

A mileage reimbursement includes more than just gas. Fuel only constitutes 17% of a driver’s vehicle expenses. Reimbursable car expenses include other costs like depreciation, auto insurance, taxes, maintenance, tires, and more.

The employee is hazarding an expensive piece of personal property. Consequently, several employee-friendly states (e.g. California, Illinois, Massachusetts, etc.) have labor laws requiring reimbursement of personal vehicles.

CA Labor Code Section 2802(a) states that:

“An employer shall indemnify his or her employee for all necessary expenditures or losses incurred by the employee in direct consequence of the discharge of his or her duties.”

Section 2802(c) defines “necessary expenditures” to include “all reasonable costs.” These reasonable costs can include both operational and ownership costs.

While many states do not require reimbursement of business expenses, a competitive employer will offer a robust program. So even if your organization operates in states without these laws, be aware of the vehicle costs it is fair to cover.

A mileage reimbursement covers the following costs:

A mileage reimbursement first should cover the business portion of ownership costs (or fixed expenses). These include

- depreciation

- car insurance

- taxes, license, and registration

Second, a business mileage program should cover operational costs (or variable expenses). These include

- fuel

- maintenance

- oil changes

- tires, brake pads, etc.

California Labor Code

2802(a) self-audit

How to calculate business mileage reimbursement costs

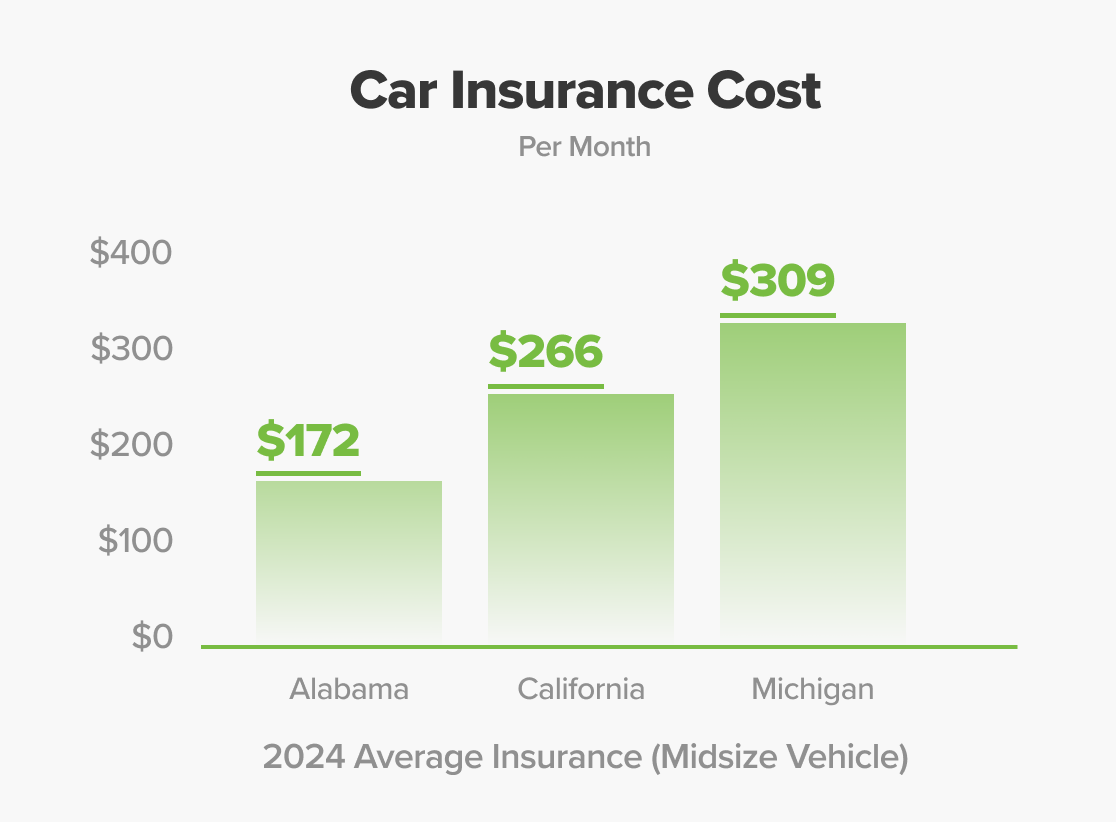

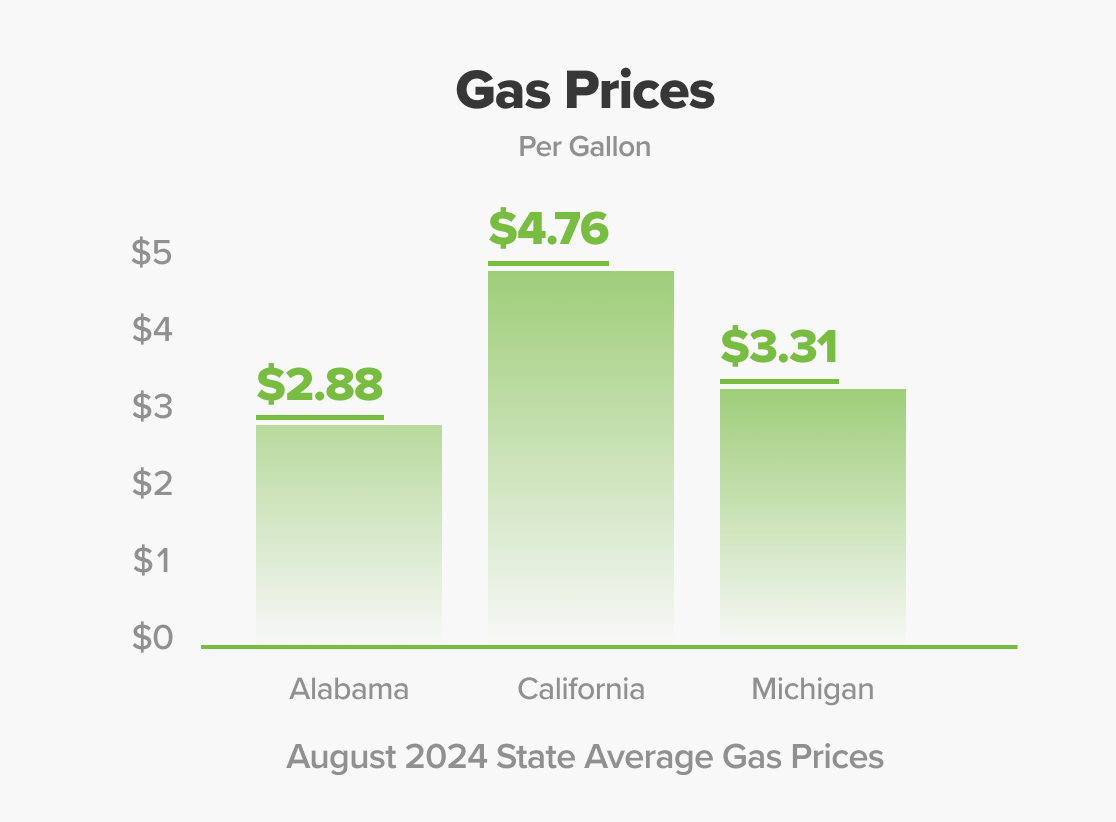

Calculating an optimal reimbursement rate is complicated. This is because different employees experience different costs. Louisiana drivers pay the most for car insurance. California drivers pay high gas prices. Some employees travel 1,000 miles every month while others travel 3,000 miles.

In the next chapter we'll look at a variety of ways to reimburse vehicle costs. If you’d like to see more specific comparisons of vehicle costs in different parts of the country, read

4 Steps to a Fair 2025 Mileage Rate.

Before adjusting your rate or just sticking with the IRS mileage reimbursement, you need to resolve two questions:

- Is the mileage reimbursement taxable?

- Is this the best plan for my organization?

Is a mileage reimbursement taxable?

IRS Tax Rules for Mileage Reimbursements and Car Allowances

It is important to know what IRS guidelines consider taxable vs. non-taxable (a.k.a. non-accountable vs. accountable plans).

The primary distinction lies between reimbursement and compensation. IRS Publication 463 distinguishes between plans that prove the business use of mileage or expenses and plans that do not. If the employer cannot demonstrate business use, the payments are compensation and therefore taxable.

Generally speaking, any mileage reimbursement up to the IRS business rate is exempt from taxation, whereas a standard monthly car allowance is taxable compensation. Below is a list of common business vehicle plans and their tax exempt status.

1. Mileage rate (cents-per-mile)

The company multiplies the employee’s monthly reported mileage by a specific cents-per-mile rate and pays the resulting amount. As long as this business mileage rate does not exceed the IRS business mileage rate ($0.70/mile for 2025), the payment is considered a reimbursement and non-taxable. The simplicity of this approach makes it by far the most popular of IRS accountable plans.

2. Monthly car allowance

Instead of paying a fixed monthly amount, a company can multiply the employee’s monthly reported mileage by a specific cents-per-mile rate and pay the resulting amount as a reimbursement. The reimbursement remains non-taxable as long as the company mileage rate does not exceed the IRS standard business mileage rate.

3. Car allowance with mileage substantiation

To prove that a monthly car allowance is a reimbursement, a company can track the business mileage of its employees. This mileage is multiplied by the IRS mileage rate. The employee then receives the lesser of the car allowance amount and the mileage rate multiplied by the mileage.

4. Car allowance and mileage reimbursement

Some companies pay a fixed amount along with a mileage reimbursement. The fixed allowance is taxable but not the mileage reimbursement, as long as the mileage rate does not exceed the IRS business rate.

5. Car allowance plus fuel card or fuel reimbursement

Other companies supply employees with a gas credit card or reimburse the receipts for gas expenditures. Without mileage substantiation, the car allowance remains taxable, as well as any portion of the fuel expenditure that cannot be demonstrated as business use (unless the employer charges the employee back for the personal use).

6. Fixed and variable rate reimbursement (favr)

Whereas the IRS mileage rate was designed to be a tax deduction tool for individuals, fixed and variable rate was designed for business reimbursements. A FAVR plan allows an employer to reimburse employees accurately while keeping the reimbursement tax-free. Using expense data for the employee’s garage zip code, the employer pays a combination of a fixed monthly amount and a variable reimbursement rate.

The best policy for your business?

Out of these six options, most likely the best fit for your business will be a cents-per-mile rate or fixed and variable rate plan. The rest of this guide will focus on that question, examining the pros and cons of typical mileage reimbursement programs and how to adopt the right policy for your organization.

Is mileage reimbursement a good fit for your company?

The two most popular business vehicle policies – the car allowance and the federal mileage rate – are popular because they are easy to understand and simple to administer.

But simplicity and ease come at a cost.

As the mobile workforce has grown, these “one-size-fits-all” models face limitations. Car allowances often fail to keep up with employee expenses because taxes reduce take-home pay. The same is true if allowances do not adjust up for drivers with large and/or expensive territories.

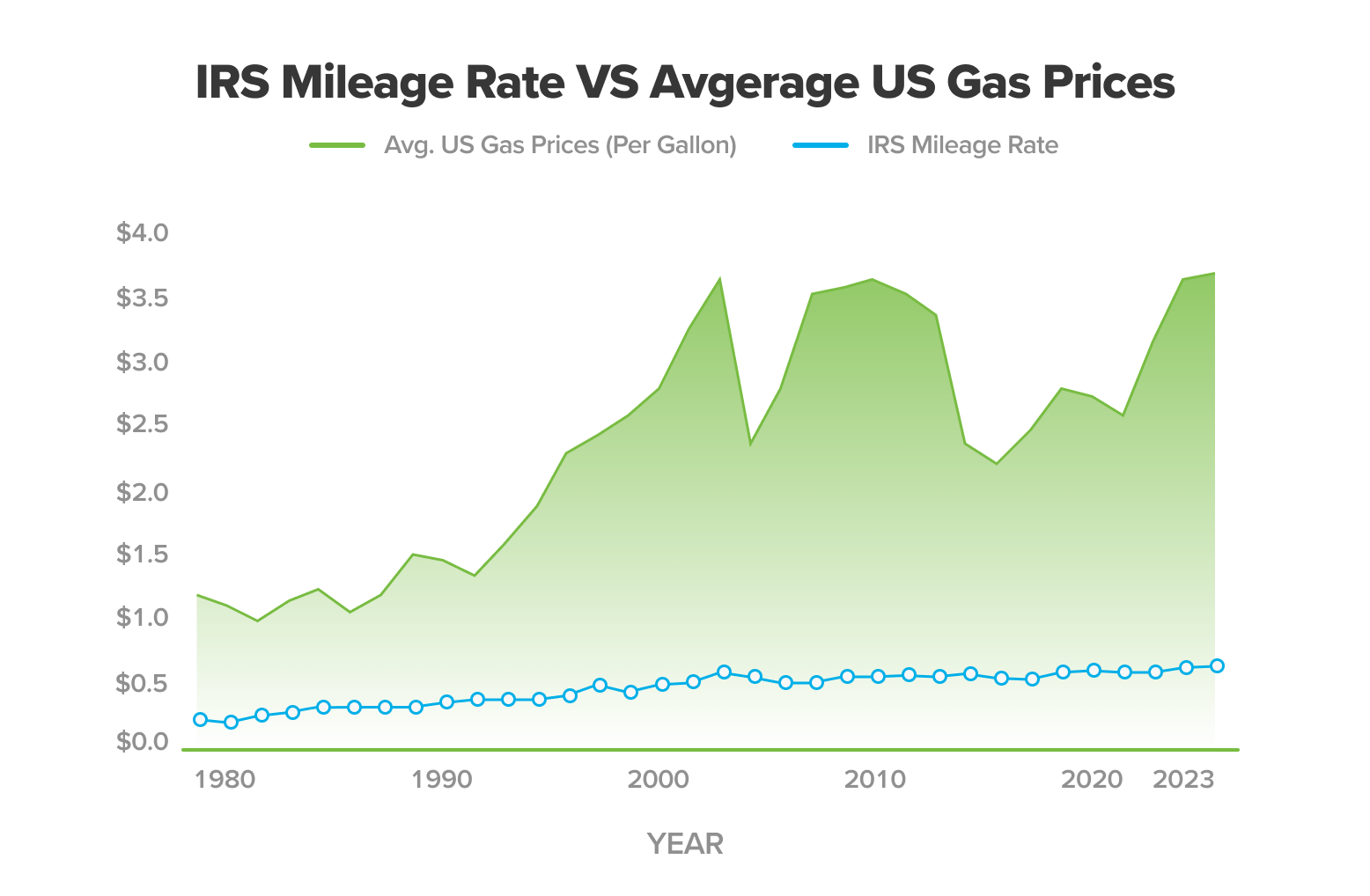

Similarly, the IRS mileage rate, created as an individual tax deduction tool, has become less suitable as total mileage amounts have increased. The government mileage rate, intended to measure of average vehicle costs, cannot capture costs with precision. This national mileage rate does not work for every locality or for drivers with high or low mileage.

IRS mileage reimbursement rate vs. geographically sensitive costs

Compare the average gas prices and insurance premiums across three different states:

Equal mileage reimbursement rate vs. unequal costs

A company-wide mileage rate can work if all employees live in similarly-priced geographic regions and drive similar amounts per month. However, a company that operates in multiple regions will have employees facing different localized costs, such as for fuel and insurance.

A small company whose employees all drive between 1,000 and 1,500 miles per month may find the IRS mileage reimbursement rate a suitable tool, but a larger company with more high-mileage employees may find this federal mileage rate unaffordable.

The IRS standard business rate will over-reimburse high-mileage drivers and under-reimburse drivers who cover small territories yet face high fixed costs (e.g. insurance, depreciation, taxes).

Equal

A standard rate or amount cannot address the variety of expense needs that arise with employees covering a variety of territory sizes in different parts of the country. Disparities will emerge:

Equitable

Is a standard mileage reimbursement best for your organization? That depends on the variety of mileage amounts and locations of employees. The next chapter will explore these challenges and best practices for solving them.

What are the challenges of mileage

reimbursement?

Mileage reimbursement at a standard rate faces three challenges: unequal vehicle expenses, lack of precision, and cost control.

1. Expense variations

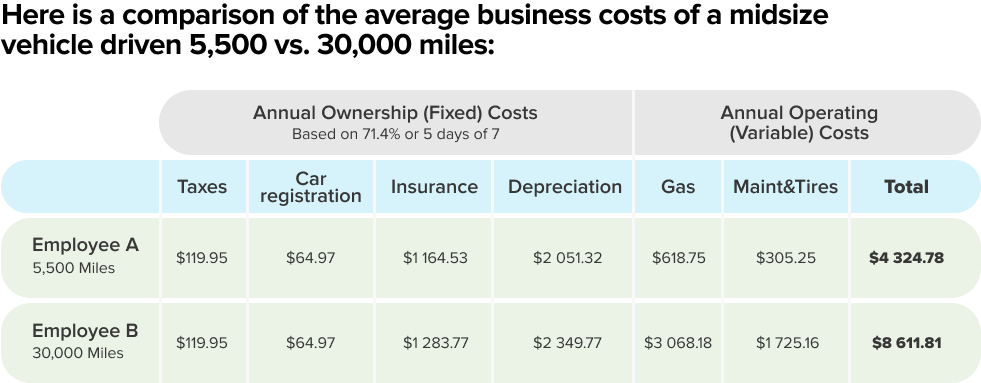

In theory, a mileage rate should help with expense variations because more driving incurs more costs. In reality, vehicle expenses fall into two categories: fixed and variable.

Fixed costs, such as insurance, taxes, and depreciation, become less costly per mile when spread over a higher number of miles driven.

Variable costs, such as gas, maintenance, and tires, tend to increase with miles driven, though other factors such as gas prices impact these as well.

As a result, a high-mileage driver tends to be over-reimbursed relative to a low-mileage driver.

Here’s an illustration using the 2023 IRS rate, which was $0.625/mile that year:

Both employees pay the same amount for their driver’s license, vehicle taxes, and car insurance (for the most part). Employee B will spend more on maintenance and tires and spend a lot more for gas. But Employee B is not going to spend $14,210 more in gas, maintenance, and tires than Employee A. Plus, Employee A’s car depreciation by itself will likely exceed $2,000.

Employee A got shortchanged. Employee B made bank. This is a huge inequality, and it happens all the time.

Most mileage rates do not fluctuate with gas prices, adding to the problem. For example, the IRS rate only generally tracks with gas prices but historically has not adjusted with spikes.

2. Lack of precision

The IRS mileage rate was never designed to accurately reflect all motorists’ vehicle costs. Instead, the government rate is derived as an average of all vehicle expenses across the entire United States from the previous year, which works just fine in terms of taxation but less so for companies seeking to accurately reimburse employees.

Different motorists in different parts of the country experience different levels of expense per mile driven. But as far as the IRS is concerned, it all averages out across all tax returns. Some taxpayers end up deducting more than their actual costs, while others less than their actual costs – but it all evens out for Uncle Sam.

If mobile employees are being shortchanged by the IRS rate, they may drive unnecessary miles to increase their reimbursement. If they are being over-reimbursed, however, that becomes an expense problem for the company.

3. Cost control

Most companies rely entirely on the employee to record business mileage. This creates a cost control problem.

Because neither the IRS mileage rate nor most company-derived mileage rates adjust automatically with gas prices, there are times when a sudden increase in gas prices brings a sudden decrease in cash flow for the employee. The same thing happens if their insurance or personal property tax rates increase.

In situations where business expenses increase but the mileage rate stays the same or only slightly increases, an employee will seek ways to recoup the loss of income.

Depending on what type of mileage log the company uses, this could mean adding extra mileage to the log, or it could mean driving extra, unnecessary miles.

If your company uses an Excel spreadsheet to record mileage, what’s to stop an employee from fudging the numbers? Similarly, if employees are estimating mileage to save time, why wouldn’t they “round up” in their calculations?

When reimbursing mileage, it can be very difficult to control costs because calculating the mileage reimbursement remains largely in the employee’s hands.

4. Best practices to address mileage reimbursement challenges

Best practice one: use a mileage rate that is based on actual data

Remember, the IRS rate is an average of all averages. You need to find out what range of expenses your employees experience in their respective territories and roles. A good starting point would be to look at gas prices, average insurance premiums, and tax rates in each employee’s territory.

All of this information can be found through a simple Google search. For a more comprehensive approach, contact mBurse to obtain cost data for each employee’s territory, which can help guide you in choosing an appropriate mileage rate that can be adapted to different employees’ needs.

Best practice two: use a mileage rate that tracks with changing expense data.

If your mileage rate fluctuates with gas prices, employees will be far less likely to offset a price increase by reporting extra mileage. Make sure to have a person whose job involves evaluating the mileage rate on a regular basis to make sure it’s neither shortchanging nor overpaying employees.

Best practice three:

switch to a FAVR

reimbursement model

Fixed and variable rate reimbursement combines practices 1 and 2. FAVR also addresses the discrepancy between high-mileage and low-mileage drivers by paying a set monthly amount with a variable mileage rate.

What Is FAVR?

Best practice four: use an accurate mileage log

When it comes to tracking business mileage, the most accurate mileage logs available today are GPS apps that employees can operate from their smartphones. These apps precisely capture business mileage without any manual reporting. The mBurse GPS app, mLog, offers features that protect each driver’s privacy.

These GPS mileage logs can also integrate with the company's CRM software and payroll software to keep employee time focused entirely on job responsibilities. There are quite a few options when it comes to mileage tracking and it's best to make an informed decision on what fits your company and culture.

Hidden mileage reimbursement costs

that affect the whole company

Getting your vehicle reimbursement policy wrong can impact nearly every aspect of your organization.

We’ve already covered problems with cost control and inequitable compensation due to expense variations. But weaknesses in a reimbursement plan can impact other aspects of an organization:

Company risk management

When an employer reimburses employees insufficiently, those employees will seek recourse. Labor code lawsuits are a distinct possibility in employee-friendly states. Or an employee might reduce his or her auto insurance coverage.

If that employee causes a car accident while working, any gap between the employee’s insurance and the costs of the accident will now become the responsibility of your company.

Employee productivity

Under-reimbursement can also drive a wedge between reported mileage and employee productivity. If your drivers self-report their mileage, they may decrease driving while reporting the same mileage or increase reported mileage without increasing productivity.

A mileage reimbursement incentivizes the accumulation of mileage, not improvement in sales or client relationships. In the end, employees may focus more on protecting their income than on protecting client relationships or boosting sales.

Attraction and retention of employees

Insufficient or inequitable reimbursement for vehicle expenses will drive some employees out the door. Look at your attrition rates. Has employee attrition increased over time? The company mileage rate may not cover the fixed costs of drivers with small or expensive territories.

Potential employees will also learn what they can about the company’s car reimbursement plan. If they project insufficient reimbursement, they may not accept a job offer or apply in the first place.

Why tax rules put pressure on your

vehicle reimbursement policy

Vehicle reimbursements have assumed even greater importance due to the tax code changes.

Under the Tax Cuts and Jobs Act (TCJA), enacted December 21, 2017, employees cannot write off unreimbursed business expenses during the 2018-2025 tax years.

In the past, an employee receiving a mileage rate less than the IRS business rate could deduct the difference between their company’s mileage rate and the IRS mileage rate. An employee receiving the IRS rate could deduct the difference between actual expenses and the total mileage reimbursement benefit.

Either way, the employee had recourse to offset an insufficient car reimbursement plan. Now, drivers may seek other recourse, such as lawsuits for labor code violations.

The elimination of this popular deduction puts pressure on companies operating in employee-friendly states like California and Massachusetts, which have labor codes that indemnify employees from business expenses.

These labor laws strictly prohibit companies from passing on business expenses to employees.

In January 2019, Illinois enacted the same kind of law. In the wake of tax reform, other states may also begin dictating full reimbursement. A group of states already has labor code protections that favor employees when it comes to business expenses (CT, RI, MI, ND, AZ, FL, and SD).

Employees will increasingly pursue full reimbursement from their employers, and state legislatures will increasingly face pressure to pass new labor laws protecting employees.

Among employees who receive a mileage reimbursement, the two groups most affected by the tax reform will include low-mileage drivers and moderate-mileage drivers operating in expensive geographical locations.

Comparing two drivers under the pre-2019 tax code shows why:

Both drivers received a helpful benefit under the old tax code that the slightly reduced income tax brackets will not be able to offset.

Without a response to this new tax code reality, companies may lose employees like Driver 1 and Driver 2 or find themselves in court—which could get a lot easier as state legislatures strengthen labor laws in response to tax reform.

The reality should add urgency to determining a fair mileage reimbursement rate in 2024.

What's your optimal mileage rate

in 2025?

The current tax landscape combined with rampant inflation necessitates getting your car reimbursement policy right.

For four years now millions of mobile employees have filed tax returns without being able to write off vehicle expenses using Form 2106. Employers that have not increased their vehicle reimbursements commensurably are facing renewed pressures.

From 2021 through 2023, inflation hit vehicle costs hard.

Workers are feeling whiplash and financial uncertainty. They need to know that their employer will responsively make adjustments to protect their income.

Unless you’re already properly reimbursing your employees, sticking with the status quo will hurt your company and your employees.

Take concrete actions now to review and adjust your car reimbursement plan according to best practices. At the very least, take the following steps:

- Estimate employee car expenses and compare these with their reimbursement amounts.

- Determine if the current range for employee mileage is creating inequitable reimbursement or cases of under-/over-reimbursement.

- Determine whether reported mileage matches actual employee productivity.

- If you aren’t using a GPS-based mileage log, research this new technology.

- Explore FAVR reimbursement. FAVR is the most accurate and defensible policy, addresses the tax code changes, and solves pandemic-related car reimbursement challenges

So...what’s the best mileage reimbursement rate?

Hopefully, you’ve figured out the answer: It’s complicated!

Because two employee drivers within a single organization can experience widely different costs, and because mileage rates do not sufficiently address fixed vehicle costs, there’s no quick and easy way to determine the right reimbursement amount.

To determine the right amount, you have to know the employee’s zip code and geographically-influenced fixed costs. You also need to attend to the ratio between the mileage driven and actual expenses.

But there are some clear-cut principles that you can follow that will work under all circumstances, including the unpredictability introduced by the pandemic these past two years:

One-size-fits-all CANNOT be your solution

Because the expenses among employees will vary, the mileage reimbursement rate must be able to generate geographically-sensitive payment amounts. It’s possible that a small company with a narrow range of employee expenses can get away with a standard mileage rate, but even then there will be disparities between expenses and reimbursement for some employees

Territory size and miles MUST factor into the amount the employee receives

The number of miles driven affects everything from fuel consumption and tire wear to maintenance and depreciation. Remember that high-mileage employees can end up being over-reimbursed once they reach a certain number of miles, if they are paid a flat mileage rate. Similarly, low-mileage employees can get shortchanged if their mileage rate does not cover their fixed expenses like depreciation and insurance.

Geographically-based costs MUST affect the amount the employee receives

Gas prices, insurance premiums, taxes/registration/license fees, and maintenance costs are all regionally-sensitive. And some of them will be a lot higher than you expect. It’s vital to calculate, given a reasonably-sized vehicle garaged in a particular zip code, what each employee’s expenses will be and to incorporate that data into the amount the employee receives.

Using vehicle data to calculate reimbursement rates

In summary, accurate vehicle cost data must drive accurate vehicle reimbursements. This is the only way to ensure equitable reimbursement and to rein in costs from over-reimbursement and protect employees from under-reimbursement.

To give you an idea of actual vehicle cost data, we’ve created a helpful graphic below. Look at different parts of the car image to discover the average amount U.S. drivers experienced in each vehicle expense category a couple of years ago. What you find may surprise you.

When you add up these average annual costs, you get a monthly expense of $615.50. And that’s average. If you had been paying the IRS mileage rate of $.56/mile in 2021, your employees needed to drive 1,099 miles per month to break even. And that’s if they experienced average annual costs. (Since then, costs have increased by 20 to 30% across the country!)

But what if they drove 1,200 miles/month in California, with some of the highest gas prices and maintenance costs in the U.S.? Or in Michigan, where insurance rates are the highest in the country?

Did that extra 130 miles net the amount they need to cover their geographically-based costs? And what about depreciation and insurance costs for low-mileage drivers? Together make up 60% of the costs of owning a car and have little relationship with miles driven.

From the company perspective, you’ve also got a cost-control problem from high-mileage drivers putting in 2,000 or 3,000 or 4,000 miles per month. That IRS rate will rapidly exceed the drivers’ actual expenses, especially if they live in less expensive parts of the country.

Where do you go from here?

Well, you could use these average costs to estimate the needs of your individual employees based on whether they face below average or above average costs as determined by geographic location, territory size, and vehicle type. But you could also use tools that will give you more specific data.

mBurse can quickly provide the data and pinpoint an ideal car allowance amount or mileage rate for your drivers. Read 4 Steps to a Reasonable 2024 Mileage Rate or visit our Professional Services page to explore mBurse offerings.

Conclusion: Fix your vehicle

reimbursement for 2025

The time is now – review the recommendations throughout this guide, and commit to developing a cost-effective policy that pays a fair and reasonable vehicle reimbursement.

If you wait until next year to make changes to your mileage reimbursement policy, what will the consequences be?

What is a reasonable car reimbursement this year?

Partner with experts who make saving you and your people money easy.