Everything You Need to Know about Car Allowances

Your definitive guide to developing

a smart car allowance policy in 2025.

To begin, take our five-question quiz on car allowances. If you can't answer all the questions, no worries – you'll find the answers woven throughout.

Test your car allowance knowledge

Does your organization employ anyone who travels for work using a personal vehicle? These mobile employees make sales calls, manage accounts, provide training, attend conferences – and more. Mobile employees should be compensated for the business use of their vehicle. Most employers use a set monthly car allowance, a cents-per-mile reimbursement, or some variation on these approaches.

If your organization pays a mileage reimbursement or is considering one, check out Everything You Need to Know about Mileage Reimbursements.

If your organization's priority is to calculate the optimal car allowance for your employees, then start the process here:Calculate your 2025 Car Allowance

Or read on to discover everything employers and managers need to know about car allowances in 2025.

If your organization pays any form of an employee car allowance, you need to answer these questions:

- How did you calculate your employee car allowance amount?

- How long has it been since you reviewed the allowance amount?

- Does the car allowance cover the expenses of every employee?

- Is the car allowance taxable?

- If so, are you properly withholding taxes?

If you have trouble answering any of these questions, chances are your car allowance policy is costing your organization in hidden ways and is in serious need of an update.

An optimized car allowance policy can accomplish a range of company goals:

- Save time and money

- Support mobile employees equitably?

- Attract and retain talent

- Protect the company from mobile employee risks

- Chapter 1 What does a car allowance cover?

- Chapter 2 Is my car allowance taxable?

- Chapter 3 Is my car allowance equitable?

- Chapter 4 Car allowance challenges

- Chapter 5 The organizational impact

- Chapter 6 Is your car allowance compliant?

- Chapter 7 The right policy and amount

- Chapter 8 Conclusion: Calculate now

What should a car allowance cover?

For a lot of businesses, the burning question is

How much car allowance should I pay?

But before you calculate a fair car allowance amount, you have to know what expenses your employee car allowance should cover.

Fuel is the obvious one, but there are many others. For the average driver fuel only constitutes 17% of the costs of vehicle operation.

Several states (California, Illinois, Massachusetts, Rhode Island, and the Dakotas, to name a few) have laws that specify the work-related vehicle expenses that should be covered by a car allowance. We'll use California’s law as our guide.

CA Labor Code Section 2802(a) states that:

“An employer shall indemnify his or her employee for all necessary expenditures or losses incurred by the employee in direct consequence of the discharge of his or her duties.”

Is Your Car Allowance

Labor Code Compliant?

When calculating a fair car allowance, what counts as a reasonable cost?

Operational costs

Adding business use to a personal vehicle means increased fuel consumption and increased wear and tear, with more frequent changes of oil, tires, brake pads, etc.

Ownership costs

If the job requires a vehicle, the employer should reimburse the business portion of property taxes, registration, depreciation, and car insurance. On average around 60% of the costs of a vehicle go to insurance and depreciation.

An auto allowance should cover out-of-pocket expenses:

Fuel, oil, tires, taxes, registration, insurance, depreciation...

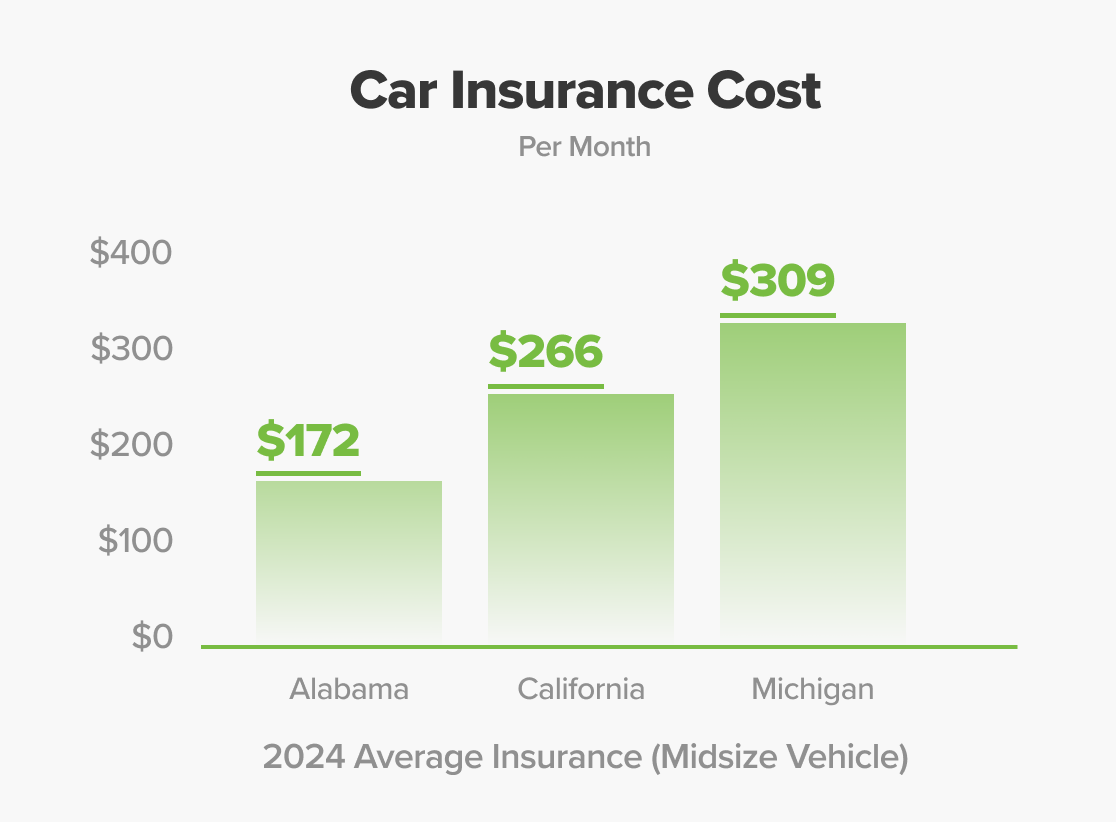

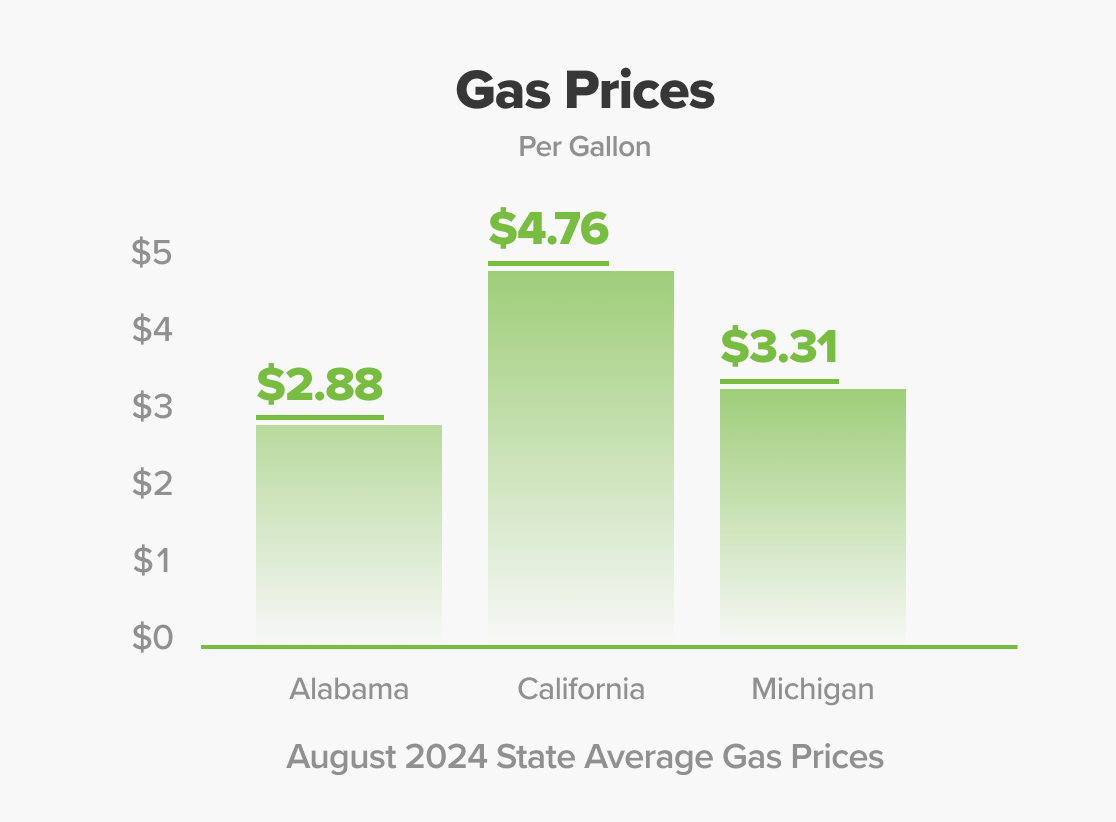

Not all employees experience the same costs, though. Auto insurance premiums are higher in Michigan than in Oklahoma. Gas prices are higher in California than in South Carolina. Some employees travel 1,000 miles every month while others travel 2,000 miles.

You need specific data on geographic variations in driving costs to calculate a fair car allowance. You can learn more by reading Four Steps to a Reasonable 2025 Car Allowance.

You must also determine whether the allowance is taxable and whether your company complies with IRS guidelines. Our next chapter will discuss this.

Should I tax my car allowance?

Because taxes greatly reduce take-home pay, you must factor in taxation when calculating how much car allowance to pay. Here are the tax implications for common methods of paying for employee vehicle expenses.

1. Standard car allowance

A fixed monthly car allowance is considered taxable income at the federal and state levels. Employees and employers must also pay FICA/Medicare taxes on the allowance. After all these taxes, a car allowance may be reduced by 30–40%. Consequently, the employer must ensure that the post-tax amount can cover an employee’s vehicle expenses, not the pre-tax amount. One of the tax reform results is that it eliminated the business mileage deduction. The Tax Cut and Jobs Act eliminated the business mileage deduction or the ability to write off reimbursed business expenses for employees until 2026

2. Car allowance with mileage substantiation

A company can avoid taxation by tracking the business mileage of its employees. Every month, each employee’s mileage is multiplied by the IRS mileage rate ($0.70/mile for 2025). The employee then receives the lesser of the car allowance amount and the mileage rate multiplied by the mileage. In the past, excess mileage could be deducted from income taxes, but that is also not an option until 2026.

3. Car allowance plus fuel card or reimbursement

In addition to a fixed allowance, a company can supply a credit card used to purchase gas or can reimburse fuel receipts. Not only is the car allowance taxable compensation, but so is any portion of the fuel expenditure that cannot be demonstrated as business use. The company must charge back the employee for any personal gas use to avoid taxation.

4. Mileage reimbursement

Instead of paying a fixed monthly amount, a company can multiply the employee’s monthly reported mileage by a specific cents-per-mile rate and pay the resulting amount as a reimbursement. The reimbursement remains non-taxable as long as the company mileage rate does not exceed the IRS standard business mileage rate.

5. Car allowance with mileage reimbursement

In this case the company pays a fixed monthly amount plus a mileage reimbursement. The monthly car allowance is taxable but not the mileage reimbursement, as long as the mileage rate does not exceed the IRS business rate.

6. Fixed and variable rate car allowance (FAVR)

This non-taxable approach combines a fixed monthly allowance with a variable mileage rate. FAVR was designed as a corporate expense tool to reimburse employees more accurately than a standard car allowance or mileage rate. A FAVR car allowance achieves precision by using expense data for each employee’s garage zip code to set the fixed allowance and the variable rate.

What are the advantages of a FAVR plan?

Is my car allowance equitable?

Standard car allowances and mileage reimbursements are popular because they are simple to understand and easy to administer. But their simplicity and ease create unfair outcomes.

Originally, car allowances served as a catch-all to cover car expenses and a way to increase compensation without negotiating salary. When fewer jobs involved travel using a personal vehicle, this system worked fine.

But with cars now becoming a de facto "office," the standard car allowance has not kept up with expense needs. Under-reimbursement has become a problem, intensified by the elimination of the tax deduction for business mileage and inflation in vehicle costs. After taxes, many business drivers get shortchanged.

The solution isn’t as simple as increasing every employee’s monthly car allowance.

That approach could get prohibitively expensive, and an increase might not be necessary for a low-mileage driver operating in an inexpensive part of the country.

Switching to the IRS business rate can also create challenges. Mileage reimbursement introduces problems with cost control – employees can drive more to earn more.

At 70 cents per mile, the IRS rate gets expensive fast. Plus, low-mileage drivers will be under-reimbursed.

As the following chart shows, a standard car allowance and a mileage rate share a fundamental problem: applying an equal amount or rate to unequal expense needs.

Equal

A company with a variety of employees driving for work cannot address that variety using a standard rate or amount. Disparities will emerge due to varying territory sizes and costs. These disparities can only be resolved through a customized vehicle reimbursement:

Equitable

Customizing your policy by adding fuel reimbursement or mileage substantiation may help, but may increase costs or decrease productivity. It’s crucial to understand the limitations inherent to each policy before determining the best policy for your company and your employees. In the next section, we’ll dig deeper into flaws inherent to car allowances.

Improve your car

allowance in 3 easy steps

The challenges with most car allowances

An auto allowance has three drawbacks:

1. Tax Waste

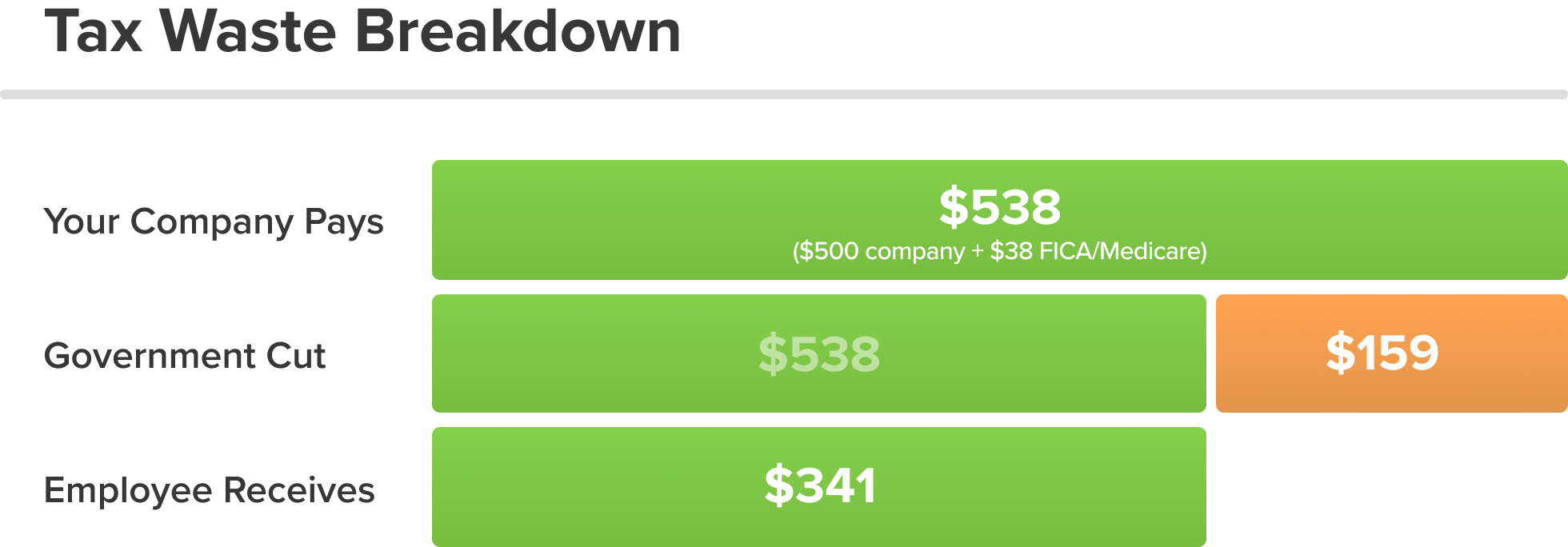

Given a $600 monthly allowance, how much actually goes to pay vehicle expenses? Less than you’d think. An employee in the 24% tax bracket will take home only $410.10 after subtracting both income taxes and FICA/Medicare. That amount will decrease further if the car is garaged in a state that levies an income tax.

On top of this, the company pays $45.90 for FICA/Medicare on that $600. Here's an infographic representing the same calculations applied to a $500/month allowance:

Given the vehicle expenses an allowance should cover – gas, maintenance, depreciation, insurance, etc. – will that $341 truly suffice? or the $410, if you pay a $600 allowance? Because the IRS considers a car allowance a taxable benefit and not an expense reimbursement, employees are left playing catch up. Why not divert the tax money away from the government and back into your organization?

How much can you save?

2. Variations in expenses

A single employee’s expenses can vary month-to-month. Two different employees in the same company can have widely different expenses. Gas prices rise and fall, territory sizes differ, and geographically-sensitive expenses can vary widely.

Compare the average fuel and insurance costs between three different states from 2018 (expenses have increased significantly since then):

Paying everyone the same amount can create fairness problems, shortchange some employees, and lead to undesirable employee behavior, such as curtailing business trips to save money.

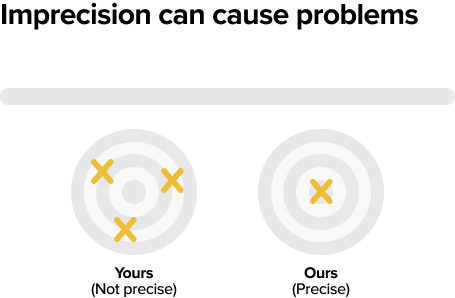

3. Lack of precision

As recently as 2018, mBurse's Annual Auto Allowance Survey revealed that only a quarter of companies calculated their car allowance using vehicle expense data. And 73% had gone ten years or more since last updating the allowance amount.

In the next year's survey, 62% reported complaints from employees about the car allowance. How can anyone expect their allowance to meet all employees’ needs when the amount has no basis in data and goes unreviewed for years?

How to boost car allowance take-home amounts

Bad options:

- Boost everyone's car allowance company-wide (taxes!)

- Switch to a mileage rate or add a fuel card (too expensive)

- "Just write it off on next year's taxes" (not possible for 2018-2025

Taxes eat up 30-40% of a typical allowance. Mileage rates incentivize over-reporting of mileage (or unnecessary driving). Fuel cards are not cost-effective. Employees cannot deduct unreimbursed business expenses, including business mileage. (Only independent contractors can.)

Solutions to the Big Three challenges of car allowances:

As you can see, taking any step to address the shortcomings of car allowances will cost time or money or both. Most solutions require adding a mileage log as well. But to do nothing will cost more in the long run.

Simply switching to a mileage reimbursement like the IRS mileage rate cannot solve the problems of expense variations and lack of precision and adds a new challenge: cost control. (See Why the IRS Rate Overpays Some Workers and Underpays Others.)

Only a fixed and variable rate car allowance can eliminate tax waste while solving these problems. We’ll explain this, and how a FAVR program is more cost-effective. But first, let’s look at how your car allowance policy impacts every aspect of the company.

How your car allowance affects your company

Getting the vehicle policy right or wrong can impact numerous parts of an organization.

We’ve already covered tax waste and inequitable compensation of employees due to expense variations. But there’s also a domino effect that touches other aspects of an organization:

Risk management for employee drivers

If you fail to sufficiently reimburse all employees, you open the door to labor code lawsuits and to employees taking risky measures to cut costs. For example, an employee might reduce insurance coverage.

If that employee causes a car accident while working, your company’s insurance may be forced to close the gap between the employee’s insurance and the costs of the accident.

Mobile workforce productivity

Under-reimbursed employees may also recoup lost income by reducing the amount of driving they do. Reduced travel can mean fewer face-to-face meetings with clients and potential clients. Over time, less driving may compromise sales productivity and client relations.

Attraction and retention of employees

Some employees will leave if they cannot obtain equitable reimbursement. Check your attrition rates. If you have not adjusted the allowance or reimbursement recently, don’t be surprised if attrition has increased. Similarly, if prospective employees project insufficient reimbursement, they may not seek or accept a job at your company.

Is my car allowance taxable?

Because taxes greatly reduce take-home pay, you must factor in taxation when calculating how much car allowance to pay. Here are the tax implications for common methods of paying for employee vehicle expenses.

1. Standard car allowance

A fixed monthly car allowance is taxable income at the federal and state levels. Employees and employers must also pay FICA/Medicare taxes on the allowance. After all these taxes, a car allowance may be reduced by 30–40%. Consequently, the employer must ensure that the post-tax amount can cover an employee’s vehicle expenses, not the pre-tax amount. One result of the tax reform was the elimination of the business mileage deduction. The Tax Cuts and Jobs Act eliminated the business mileage deduction and the ability to write off reimbursed business expenses for employees until 2026

2. Car allowance with mileage substantiation

A company can avoid taxation by tracking its employees' business mileage. Every month, each employee’s mileage is multiplied by the IRS mileage rate ($0.70/mile for 2025). The employee then receives the lesser of the car allowance amount and the mileage rate multiplied by the mileage. In the past, excess mileage could be deducted from income taxes, but that option will not be available until 2026.

3. Car allowance plus fuel card or reimbursement

In addition to a fixed allowance, a company can supply a credit card used to purchase gas or can reimburse fuel receipts. Not only is the car allowance taxable compensation, but so is any portion of the fuel expenditure that cannot be demonstrated as business use. The company must charge back the employee for any personal gas use to avoid taxation.

4. Mileage reimbursement

Instead of paying a fixed monthly amount, a company can multiply the employee’s monthly reported mileage by a specific cents-per-mile rate and pay the resulting amount as a reimbursement. The reimbursement remains non-taxable as long as the company mileage rate does not exceed the IRS standard business mileage rate.

5. Car allowance with mileage reimbursement

In this case the company pays a fixed monthly amount plus a mileage reimbursement. The monthly car allowance is taxable but not the mileage reimbursement, as long as the mileage rate does not exceed the IRS business rate.

6. Fixed and variable rate car allowance (FAVR)

This non-taxable approach combines a fixed monthly allowance with a variable mileage rate. FAVR was designed as a corporate expense tool to reimburse employees more accurately than a standard car allowance or mileage rate. A FAVR car allowance achieves precision by using expense data for each employee’s garage zip code to set the fixed allowance and the variable rate.

What Is FAVR?

How to calculate the right car

allowance for 2025

The current tax landscape and inflation have raised the stakes for companies across America. This adds urgency to the quest for a fair 2025 vehicle reimbursement policy.

We are in the sixth year of a tax policy that prevents employees from writing off business mileage and other unreimbursed expenses. In an inflationary economy, workers face significant financial anxiety.

Companies that adjust to these realities have a competitive advantage over those that don't.

Now is the time to take concrete steps to investigate and adjust your company Car allowance policy:

In the wake of the lost tax deduction that hit in 2019 and the inflation that has occurred from 2021-2023, mobile employees are seeking recourse. While some may drive less or look for new employment, others may take legal action under state labor laws, including class-action lawsuits.

1. Estimate actual employee vehicle expenses and compare these with your current allowance amount. Then calculate the car allowance amount needed to close any gaps.

2. If you’re paying a taxable car allowance, calculate how much your organization could save by switching to a tax-free plan. The elimination of tax waste could fully close the gaps.

3. If you’re using a fuel card or reimbursement, calculate whether fuel consumption matches business productivity and whether your organization is properly limiting personal use.

4. Learn more about the fixed and variable rate car allowance. FAVR is the most accurate and legally defensible policy type, and it's inflation-proof and tax code-compliant because it ensures accurate reimbursement.

How much is a fair

car allowance?

The question remains: How much car allowance should you pay in 2025?

Hopefully, you’ve figured out the answer: It’s complicated!

Because mobile employees within the same organization can experience widely different costs, there’s no quick and easy way to determine the right amount. Without knowing an employee’s mileage and zip code and the size of vehicle required to carry out the job, it’s impossible for someone to tell you the right amount.

But there are some clear-cut principles that you can follow:

1. One-size-fits-all CANNOT be your solution.

Because car expenses among employees vary, the car allowance should vary. A small company with a narrow range of employee expenses may get away with a standard allowance amount, but even then there will be disparities between expenses and reimbursement for some employees – and tax waste will remain a problem.

2. Territory size MUST factor into the car allowance calculation.

Mileage affects everything from fuel consumption and tire wear to maintenance and depreciation. Employees with larger territories drive more, and should be reimbursed more. Failing to incorporate mileage into the amount will result in low productivity from shortchanged employees.

3. Geographically-based costs MUST affect the car allowance calculation.

The costs of gas, insurance, taxes, registration/license, and maintenance are regionally-sensitive. It’s vital to calculate, given a reasonably-sized vehicle in a particular zip code, what each employee’s expenses should be. Incorporate that data into the allowance calculation.

Data needed to calculate a fair car allowance

Different employees should receive different amounts and those amounts should be based on actual data. This is the only way to ensure equitable reimbursement and to prevent over-reimbursing and under-reimbursing.

To get started, use the graphic below to discover the average costs of owning and operating a vehicle by expense category. You might be surprised at what you find.

These average annual costs amount to a monthly expense of $615.50. And that’s average. Will a $600/month taxable car allowance cover the costs of the average American driver? No way! After taxes, that $600 might be as little as $400.

What about a driver in California, where gas and maintenance prices are through the roof? Or in Michigan, where insurance rates are the highest in the country?

Those drivers' monthly vehicle expenses could easily reach $1,000.

Would a mileage reimbursement work better? Not necessarily. Depreciation and insurance together make up 60% of vehicle costs. That poses problems for low-mileage drivers since fixed costs are only marginally affected by miles driven.

What's your optimal car allowance for 2025?

You could use these average costs to estimate the needs of individual employees based on whether they face below-average or above-average costs based on location, territory size, and vehicle type. But more specific data exists.

To obtain data specific to select vehicle types and a selection of geographic locations, see our additional guide to the process of pinpointing that optimal allowance or reimbursement rate: Four Steps to a Reasonable 2025 Car Allowance.

Or, you can complete our three-step process below – audit your current car allowance, complete a competitive benchmarking analysis, and then receive a free, optimized rate.

Even simpler, contact mBurse to find out about vehicle allowance program administration. You don't administer you're own health insurance, so why administer your own car allowance?

Conclusion: Calculate your optimal car allowance now

You have a responsibility to protect each employee’s income from the costs of using a personal vehicle for work.

It is now 2025. Employees know that they cannot deduct business mileage anymore. Due to inflation and potential tariffs, they face even more economic uncertainty. If you wait to optimize your policy, what will the consequences be?

Find out how much a fair car allowance is this year.

Partner with experts who make saving your company and people money easy.