4 Steps to a Reasonable 2024 Car Allowance or Mileage Reimbursement

Determining the optimal car allowance or mileage reimbursement for 2024 is possible with the right data.

4 MIN READ

4 MIN READ

In 2024, it will be more crucial than ever for businesses to get their company car allowance right. For the sixth year in a row, employees cannot deduct business mileage on their tax return.

The Tax Cut and Jobs Act (2017) eliminated this deduction for the years 2018–2025. Employee can no longer file Form 2106 to reduce their taxable income using the previous year's business mileage. Increasing inflation and financial uncertainty due to the pandemic has only complicated matters. Employers that neither increased their company’s car allowance nor switched to a tax-free allowance face more pressure than ever to boost employee benefits.

A number of employee-friendly states (California, Massachusetts, Rhode Island, North Dakota, South Dakota, and others) have instituted laws that require employers to fully reimburse employees for business expenses. Illinois did so in January 2019, amending their labor code to indemnify employees from all work-related expenses. When employees cannot write off vehicle expenses to offset any gap between their costs and their allowance or reimbursement, they may file labor code complaints.

It is vital that your organization take the time to determine the best way to fully cover the business expenses of your mobile workforce. The following four steps will help you optimize your employees’ car allowance or mileage reimbursement.

Looking for a shortcut to a 2024 rate? We'll calculate it for you.

Optimizing your car reimbursement

Understand what counts as work-related vehicle expenses.

In this article, we are focusing on employees who operate a personal vehicle in order to fulfill job requirements. If your organization issues company vehicles, then you are reimbursing a much narrower set of costs. For more information on how to properly administer a company car program, including a personal-use chargeback policy, check out our fleet management tools.

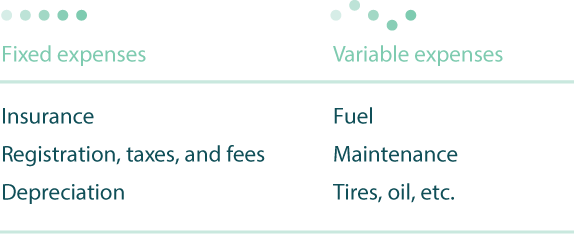

When paying a car allowance or reimbursement to cover the use of a personal vehicle, the following expenses all must factor into your rate:

All of these expenses are geographically-sensitive, since different parts of the country experience different gas prices, insurance rates, property taxes, and maintenance costs. On top of that, several expenses depend on the type of vehicle an employee drives. Fuel efficiency significantly impacts the amount of gas an employee uses, and a newer or pricier car will experience more substantive depreciation and higher insurance rates than an older or less expensive model.

So how do you accurately determine these expenses for each employee so as to guarantee sufficient coverage of expenses? That’s where data comes in.

Determine the vehicle expense data you need.

Determining the ideal vehicle reimbursement policy for your organization takes time and thoughtfulness, but it can be done with the right data.

As we concluded in both of our ultimate guides (1. To car allowances, and 2. To vehicle reimbursements), a “one-size-fits-all” approach will under-reimburse some employees and/or over-reimburse others. Accurately offsetting all employees’ vehicle costs will require you to account for

- Each employee’s territory size (i.e. miles driven)

- Each employee’s territory costs (i.e. geographically-sensitive costs)

Two employees receiving the same mileage rate for two different territory sizes and locations may experience an inequitable difference in take-home pay. This reality is exacerbated if you are using the IRS mileage rate, which creates significant inequalities between high-mileage and low-mileage drivers and promotes excessive driving.

Under a standardized mileage rate, high-mileage drivers see their fixed costs (such as depreciation) spread out over a larger number of miles, allowing them to recoup these expenses more efficiently than a low-mileage driver. Working in a more expensive territory (e.g., California) will, however, reduce an employee’s take-home pay relative to a driver working in a less expensive part of the country.

A similar effect takes place when employees receive a fixed car allowance, but this time high-mileage employees are the ones most likely to experience a gap between pay and expenses.

Unless you operate a very small company, adding up the vehicle expenses of individual employees is impractical. You need access to expense data for each expense type in relation to territory, location, and size. But before accessing this data, you need to take one crucial step.

Standardize the vehicle most appropriate to the task.

Because employees are free to choose their own vehicles, they will experience differing fuel costs and rates of depreciation, insurance, and taxation relative to the fuel efficiency, age, and model of their vehicle. It’s not right for the company to cover the added expense of a gas-guzzling, expensive model like a Range Rover or a Hummer if a mid-size sedan will do.

So before deriving the expected expense data for each employee, make sure to group all employees based on the most appropriate vehicle for their role within the organization.

Derive the rates most suitable to each employee’s location and role.

We have gathered comprehensive data from across the country to help companies optimize car allowances and mileage reimbursements. Using the chart below, you can get a rough estimate of the optimal monthly take-home pay that employees working in different parts of the country should receive. Keep in mind that, without knowing your employees’ specific work requirements and zip codes, it’s impossible to generate a precise expense estimate. So use the following chart as a general guide or tool to get you started – not as a substitute for a precise evaluation of employee expense needs.

For each of the following scenarios, we assume 1,250 miles driven per month.

As you can see, the cost of driving the same number of miles in the same vehicle can vary widely between different parts of the country. The underlying cost factors also vary. California has high gas prices, leading to high driving costs in San Francisco. Michigan has high auto insurance premiums, leading to high car ownership costs in the Detroit area.

The bottom line: If you have employees operating in different parts of the country, paying them the same monthly car allowance or the same mileage rate will lead to inequities and possibly violate state labor codes.

Remember that employees cannot write off business mileage or other vehicle expenses on their tax returns until 2026. This will make them more aware of gaps between their reimbursement amount and their expenses. If they work in a state with an expense indemnification code, they will be more likely to report a labor code violation or take the company to court.

Two Cautions about Your Vehicle Reimbursement Policy

CAUTION 1:

Don’t forget IRS taxation rules.

As you begin to determine the expense needs of your employees to pinpoint the optimal monthly allowance or mileage rate, remember that IRS taxation procedures will affect your employees’ take-home pay. As long as your mileage rate does not exceed the IRS mileage rate, then you can pay a mileage rate tax-free. But a monthly car allowance is taxable unless you utilize an IRS-approved procedure such as mileage substantiation or the fixed and variable rate allowance (aka FAVR reimbursement).

Taxes can easily reduce a taxable car allowance by one-third, so make sure to match the after-tax amount to the employee’s car expense data, not the pre-tax amount. Many companies conducting an exercise like this will decide that it’s time to jettison the taxable vehicle allowance and shift to a non-taxable program. We will explore below various non-taxable programs that mBurse can help your organization establish. Essentially, you can turn tax waste into better employee benefits while saving money in the process.

CAUTION 2:

Don’t neglect accurate mileage tracking.

If you pay a mileage reimbursement rate, it is vital to remember that even an optimized rate cannot protect your organization from inaccurate mileage tracking. Self-reported mileage is the Achilles’ Heel of mileage reimbursement. Many organizations use Excel spreadsheets or expense systems to record and calculate employee mileage. The employees often use Google Maps or some other calculation tool to estimate their monthly mileage, which they then report. However, this method carries several vulnerabilities:

- Inaccuracies due to untimely calculation: If employees do not record mileage immediately after a trip, they are liable to make mistakes or forget their exact routes.

- Confusion of business and personal mileage: It’s not unusual for employees to take detours for personal reasons, which they may or may not leave out of their calculations.

- Overestimates: Recording mileage takes time away from business activities, so some employees may quickly “guesstimate” their trip lengths to save time.

- Mileage buffering: In order to compensate for increased expenses, an employee may inflate mileage, especially when gas prices rise.

In light of these vulnerabilities, it is vital to utilize an accurate mileage tracking program, ideally using a real-time mileage tracker that transparently records trip length without invading employee privacy. To learn more about mileage tracking options, read “Everything your business needs to know about mileage tracking.”

Three mBurse vehicle reimbursement tools to consider

While undertaking the four steps we have outlined, you will likely discover that you need more precise expense data than you have time or resources to gather. There are three ways mBurse can help you generate accurate, defensible vehicle reimbursements. All of these solutions use a standard vehicle while customizing rates to specific zip codes where employees garage their cars.

Use our data to optimize your current vehicle reimbursement policy.

You answer a set of questions about your employees’ locations, territory sizes, and job responsibilities, and we use our extensive data to give you optimized rates that will work for your current car allowance or mileage reimbursement program.

Adopt our Smart Mileage Rate.

This option involves a more extensive optimization of your mileage rate. Based on your company’s goals and its employees’ territories and responsibilities, we develop cost-sensitive mileage rates for all employees. These rates adjust over time to reflect changing expense realities, allowing you to stay responsive to the volatile changes that can occur in gas prices, taxation, and more. mBurse will help you administer your program while integrating with your existing payroll and CRM software.

Read about how one company saved $635K annually with our Smart Mileage Rate.

Institute a FAVR vehicle program.

The fixed and variable rate reimbursement is the most comprehensive solution available. Using your company’s particular goals and needs, we will design and implement a non-taxable reimbursement program that precisely addresses both the fixed costs and variable costs of using a personal vehicle for work. Our FAVR vehicle program combines a fixed monthly allowance with a variable mileage rate that tracks with changing levels of expense. The best part is that we do all the work of managing your reimbursement program while integrating with your existing payroll and CRM software.

Learn more about how fixed and variable rate reimbursement works.

Take action for 2024

As you consider the variety of factors in optimizing your organization’s car allowance or vehicle reimbursement rate, it may seem overwhelming—so overwhelming that you decide to just stick with the status quo and hope that the tax reform does not negatively impact your program. But consider the following possible consequences of a “wait and see” approach:

- Labor code violations

- Unproductive or excessive driving

- Over-reported mileage

- Increased attrition

- Cost control problems

- Continued tax waste

Our goal at mBurse is to help companies save money while reimbursing employees properly. We hope that this guide to rate optimization has been helpful, but if you would like a self-guided three-step process to assess, compare, and generate a free car allowance or mileage rate, you can get started below.