Mileage Tracking: Everything Your Business Needs to Know.

Our guide to IRS-compliant mileage logs and mileage tracking apps

It is a 9 minute read

It is a 9 minute read

MILEAGE TRACKING FOR BUSINESS

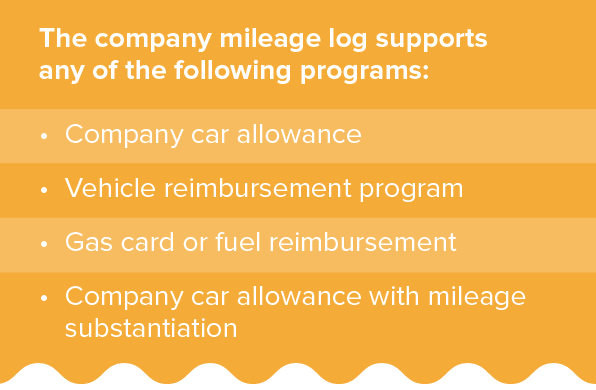

If your organization employs people whose jobs require a vehicle, there’s a good chance you operate a system to calculate and report their business mileage. Businesses have recorded employees’ mileage for a long time and for a number of reasons:

- To substantiate business mileage for tax deductions

- To keep employee car allowances tax free

- To substantiate business use of a company-issued vehicle

- To reimburse employees using a cents-per-mile rate

- To reimburse employees for fuel or substantiate a fuel card

As technology has advanced, mileage logs have increasingly taken the form of mobile apps for tracking mileage. A mileage log is any tool that can be used to store such data as trip date, business purpose, origin, destination, and miles driven.

All of the following have served as mileage logs:

- Paper mileage booklets

- Microsoft Excel spreadsheets

- Expense systems

- Expense systems with Google Maps integration

- GPS mobile apps for tracking mileage

Each form has come with its advantages and disadvantages. But when choosing how to track mileage, it’s important to understand why mileage tracking is important, and how the choice of a mileage log can impact an organization on multiple levels.

Let’s start with why tracking mileage is important.

CHAPTER :

Why you need to track business mileage

IRS-compliant mileage logs are a necessity for organizations with employees whose job responsibilities require a vehicle.

Tracking mileage substantiates the business use of a vehicle to avoid taxing employees and to allow the company to write off reimbursements. In other words, if you want to provide a tax-free reimbursement, you have to record employees’ business mileage – unless you want to track every single car expense.

Mileage tracking for IRS compliance

The IRS distinguishes between accountable plans (tax-free reimbursement) and non-accountable plans (taxable compensation). To have an IRS-accountable plan, you must prove that all payments – whether a car allowance, a mileage reimbursement, or a fuel card – constitute reimbursement and not compensation.

To prove these payments are reimbursements, you have to show that the payments do not exceed the business expenses incurred by the employee while operating a vehicle. An IRS-compliant mileage log is the only way to prove this without resorting to the tedious process of tracking each employee’s individual expenses.

Scenario: Is this mileage log IRS-compliant?

A company that provides a gas card or gas reimbursement for personal vehicles or company cars must calculate and record the business mileage. Otherwise, there is no way to determine how much fuel was used for business purposes and how much was used for personal reasons. Without business mileage tracking, the gas is considered personal use, making the expenditure taxable for both employer and employee.

Let’s say you do keep track of mileage, but employees report it from their own records every few months, rather than using a company mileage log. In this case, your plan would still be considered a non-accountable plan under IRS rules.

What are the IRS requirements for a mileage log?

An IRS-compliant mileage log must meet the following criteria:

- Include details of each trip. This includes date, business purpose, origin, destination, odometer readings, and miles driven.

- The mileage log must be up-to-date. The IRS requires that mileage be recorded no more than 3 months after a trip has occurred.

- Contemporaneous mileage tracking is best practice. In other words, you should record the mileage the same day that the trip occurs.

- Employer keeps the records, not the employee. The employer is the one paying reimbursement and using the mileage log for tax deduction purposes.

- Maintain a mileage archive. The IRS requires a company to keep mileage records for five tax years after filing a tax deduction for business mileage.

CHAPTER :

The best mileage tracker for your business

Your company’s mileage log can impact aspects of the organization beyond taxation:

- Cost control

- Employee productivity

- Administrative efficiency

- Attrition rates

- Employee privacy

- CRM adoption by employees

The type of mileage log available has always depended on current technology. Today they exist in two main forms: manual-entry records and mileage trackers.

Mileage logs and spreadsheets

Originally, mileage logs were paper books to store entries that included trip details. Then organizations began storing mileage in spreadsheets like Microsoft Excel. Now many businesses have expense systems with mileage entry built in.

Manual-entry mileage logs are time-consuming, however. They require inputting data each week or month into the book or spreadsheet. Spreadsheets add convenience by automating the arithmetic and allowing electronic record-keeping.

Spreadsheets add convenience by automating the arithmetic and allowing electronic record-keeping.

Automated mileage tracking

More and more companies have adopted software to track and reimburse expenses. Some integrate with Google Maps and others use GPS routing.

Some of today's mobile apps continue to rely on Google Maps and manual inputs, but others use GPS tracking to automatically calculate and record mileage. All the driver has to do is press “Play” on a smartphone or tablet.

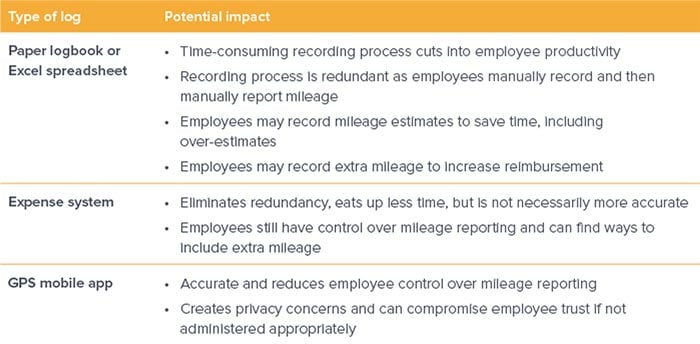

Many companies have yet to adopt these integrated mileage platforms. Mobile apps for tracking mileage hold several advantages, as the table below shows:

Choosing a mileage tracking app as the best option

The older methods involve time-consuming tasks and create loopholes that make it nearly impossible to control costs. However, many organizations have been slow to adopt more efficient mileage capture systems, whether out of privacy concerns or unwillingness to invest in new technology.

No approach has achieved perfection, but when you consider the consequences of sticking with older processes that involve self-reported mileage, you find that concerns with the latest technology pale in comparison. With proper privacy protections in place, the convenience and cost control are worth the price of the mileage app.

Try a demo or 30-day free trial of mLog, our mileage tracking app.

CHAPTER :

How to track mileage for taxes and reimbursements

It is important to know the IRS rules about who can and cannot deduct mileage on taxes. The IRS also has rules about tracking mileage for reimbursements.

Tracking mileage for tax purposes

Businesses and self-employed individuals may deduct business mileage on their taxes. For individuals, it is as simple as keeping an IRS-compliant mileage log. The individual then multiplies the annual mileage amount by the IRS business rate (70 cents per mile) and adds the number to Schedule C of their tax return.

Depending on how much they drive, an individual might prefer to stick with a manual-entry log like a spreadsheet. Or they may choose a mobile app that tracks mileage for convenience.

For corporations with multiple employees, the tax deduction may be for mileage reimbursements, fuel cards, or fleet operations. For these businesses, choosing an automated mobile app is a necessity in today's economy. Let's explore some best practices.

Tracking mileage for business: best practices

1. Ditch the mileage spreadsheets.

Accuracy is necessary for effective mileage capture. But self-reported mileage relies on humans who are prone to error and may not always act honestly.

Excel, Google Sheets, and company expense systems rely on human beings to input accurate trip data in the first place. You can reduce redundancy and opportunity for errors by using an integrated expense system, but as long as the calculations rely on human-provided data, there’s still room for mistakes and dishonesty.

2. Choose automation where possible.

Mobile employees are tasked with a wide variety of time-consuming responsibilities. Managers also have time-consuming jobs.

Automating the recording of mileage and the approval of mileage reimbursements can save significant time. Employees will have more productive work sessions and be glad to allow AI-powered software do the tracking, calculations, and approvals for them.

3. Look for integrations.

When surveying the many options of mobile apps that track mileage, look for software that integrates with existing systems. Or look for an all-in-one platform that provides mileage capture, expensing, reimbursements, approval, and business reporting all in one.

Make sure that any mileage tracking app you choose integrates with your reimbursement or travel and expense system. Even better, look for integrations with your company's CRM software.

5. Vet the software carefully.

There are dozens of mileage tracking platforms available online. Some are free, most come at a price. Most offer a free trial. Choose value over price when evaluating the software.

Beyond automation and integration, what will you be getting? Here are some key criteria:

- User-friendly interface

- Avoids battery drain

- Accessible technical support

- AI-powered accuracy

6. Remember: Google Maps is not the answer.

Google Maps is free, and it takes less time and delivers higher accuracy than other manual forms of calculating mileage. However, self-reported mileage will always lead to inaccuracies and reduced productivity.

Choosing an automated mileage tracker is a necessity in today's business world. But there remains the question of employee privacy.

CHAPTER :

Mileage tracker apps and employee privacy

Nearly everyone has used GPS to navigate on a trip, whether with a Garmin device or an iPhone app. This means that many workers don't think twice about using a mobile app to track mileage. But some individuals and businesses still have concerns about the company having too much oversight of employee whereabouts.

GPS mileage tracking vs. privacy

GPS mileage tracking is the most convenient option for mileage capture. GPS mileage tracking saves time, increases accuracy, and leverages existing hardware. Employees already use a smartphone or tablet already, so why not employ these tools to track mileage?

Edward Snowden. The NSA. Big Brother. People living in the 21st century face an unprecedented awareness of ways they can be monitored. No one wants their boss added to that list. Or do they?

How real employees feel about GPS mileage tracking

An independent survey conducted by TSheets in 2016 found that only 5% of workers who had been tracked by employers using a GPS system had a negative experience. In fact, 54% had a positive view, with the rest feeling neutral.

In 2019, mBurse surveyed mobile workers about GPS mileage tracking and found that 81% would support their employer tracking their business mileage if it meant receiving full reimbursement of vehicle expenses.

Privacy concerns tend to dissipate if an employer uses GPS mileage tracking in ways that clearly protect employees’ privacy and that don’t lead to micromanagement.

Best privacy practices for mileage tracking apps

In order to realize the benefits of GPS mileage logs without driving employees out the door, it’s important to choose an appropriate GPS app and institute guidelines for appropriate use.

1. Choose an app that delivers only business mileage data.

Drivers should be able to edit trips and designate certain portions as personal so that no data about these trips will be sent to the employer. Our GPS app mLog, for example, never shares real-time location data with employers, allowing users to designate personal mileage before data is submitted for reimbursement. Drivers should also be able to turn off the app if necessary.

2. Set boundaries for acceptable use of mileage data.

The purpose of the GPS app is to provide accurate mileage tracking for reimbursement and tax purposes – not reveal drivers' whereabouts. However, using a GPS app can boost productivity simply by providing greater visibility of work habits. The simple fact of monitoring discourages unproductive travel without any micromanagement.

It’s all about how you use the data. Reports that include long-term trends are helpful, but management should avoid looking into specific trips unless the software has flagged one as out-of-bounds. It might just be a personal trip that the employee forgot to delete.

CHAPTER :

CRMs and mileage tracking apps

An additional benefit of using a mobile app to log mileage is integration with existing CRM software. Historically, mobile employees have been slow to adopt Customer Relationship Management (CRM) tools like Salesforce.com, Oracle, and Netsuite. A mileage tracking app that integrates with your CRM will increase CRM adoption.

CRM software utilization

CRM software utilization

CRM's generate indispensable data, revealing what’s working and what isn’t. Low adoption impacts the entire organization. A properly utilized CRM can

- reveal effective and ineffective sales practices

- provide helpful data for account management

- facilitate making future projections

- equip management to coach underperforming reps

Smart companies ensure total CRM utilization. Their secret? Integrating CRM with existing tools that 100% of employees already use.

Mileage apps and CRM integration

Mobile employees already carry phones and need to log mileage. The latest GPS mileage apps integrate with CRM software and automatically feed trip data into the CRM.

Employees see the value of being reimbursed for the business use of their personal vehicle. Tying their reimbursement to the use of a mileage tracker that integrates with the company’s CRM will produce 100% adoption.

CHAPTER :

AI mileage tracking: the next step

In 2025 mileage apps are increasingly integrating AI into their functions. This next step in logging business mileage brings new levels of accuracy, accountability, and productivity.

How AI mileage tracking apps work

As designers integrate AI into existing GPS mileage apps, a number of key enhancements are achieved. These enhanced apps leverage machine learning to boost their functionality in the following ways:

- Automated, hands-free tracking

- Accurate trip classification

- Intelligent business reporting

- Improved routing of drivers

AI and business mileage tracking

Before AI integration, mileage tracking apps already were fairly accurate at sensing when a trip started and ended. This allows for hands-free, background mileage tracking. With AI, this sensing gets even more accurate, as the app learns the driving habits of the driver and can easily distinguish a business trip from a personal one

This machine learning leads to automatic, intelligent trip categorization. AI integration also is able to flag trips that seem outside parameters. That way management knows exactly which trips to look into during the approval process.

AI and business mileage reporting

The best mileage tracking apps come as part of a software platform that includes an administrative dashboard. This dashboard not only facilitates the approval process but also provides helpful business travel reporting.

AI integrations allow managers to generate reports that are finely tuned to the needs of the organization. These reports can provide insights into productivity, route efficiency, customer relations, and coaching opportunities for sales reps and other mobile workers.

CHAPTER :

Conclusion: The Best Mileage Log in 2025

While most organizations have long since left paper mileage logs behind, Microsoft Excel spreadsheets and manual-entry expense systems remain the norm for many. But is the status quo worth the hours of unproductive time and uncontrollable costs?

Choosing a mileage tracking app

The tools exist to revolutionize mileage capture. Consider the benefits of using a mobile app mileage log from the employee’s point of view:

- No more tedious compiling and reporting of mileage

- No more looking up mileage using Google Maps

- Convenient integration and automation of mileage capture and reimbursement

- Confidence that no one will second-guess recorded mileage

- Greater cost control

- Increased productivity

- More efficient reimbursement process

- Improved CRM adoption

Mileage app free trial

In the 21st century, you need a 21st-century mileage log. Take the time to explore your options. Or read our guide to vetting and comparing business mileage trackers.

New apps are being created on a regular basis. Technology continues to progress. Increasing numbers of organizations are switching to mileage apps.