Everything You Need to Know about Transitioning from a Company Car to a Reimbursement Program

10 MIN READ

10 MIN READ

INTRODUCTION:

This guide offers a comprehensive overview of the

following topics:

- Current trends in company fleets and the outlook for 2024

- Auditing a current company vehicle program

- Best practices for company fleet policies

- Alternatives to company vehicles (i.e. car allowances or reimbursements)

- Choosing the right vehicle program for your organization

- Transitioning smoothly to a vehicle reimbursement program

- Guidance for change management with employees

While the title of this guide may signal a bias against company vehicles, please note that mBurse is not anti-company car. If properly managed and used strategically, a company vehicle can be a huge asset. However, it can also lead to unsustainable expenses, unnecessary risks, and unmanaged costs.

The key is to assess whether your organization is managing your vehicle program effectively, and if not, whether it is better to improve your current fleet administration or pursue a reimbursement model instead.

This guide will prove indispensable in making those determinations. Read on to discover ways you can turn a liability into an asset – or replace that liability with a new approach that benefits your organization and its employees for years to come.

CHAPTER :

Company cars – past, present, and future

Company vehicles have formed an integral part of almost every industry for over 40 years, a huge benefit for employees but not always for employers.

Historically, organizations have pursued different approaches to develop and maintain a fleet for employee use. Some purchase the vehicles while others lease the vehicles. Some supply vehicles for commercial or heavy use (i.e., trucks and vans) and are not practical for personal use. Others supply passenger vehicles as both a work tool and a business perk – vehicles that employees also drive for personal use.

This guide will focus on passenger vehicles rather than heavy-duty vehicles.

Whether you purchase or lease a fleet of vehicles for employee use, the program is a considerable expense. But it’s also a substantial benefit to your employees. For positions that require a significant amount of driving, it has long made sense to provide a vehicle as a tool to complete daily tasks. In addition, employees expect to receive a company vehicle as part of their benefits package in specific industries.

However, as the costs of managing a company fleet continue to increase, more and more employers face difficult decisions about whether to continue, modify, or abandon their vehicle program. So let's look at the factors most relevant to operating a company fleet in 2024.

Pros and Cons of Company Cars

The primary benefit of a company fleet is the appeal to employees. A company-provided vehicle helps to attract and retain top employees. In some industries, branded vehicles can raise a company’s visibility, with employees providing constant advertising as they go about their business. In other industries, a non-branded vehicle offers the most appeal since employees operate it for personal use as well.

A company car is a huge perk. An employee with a company vehicle can reduce wear and tear on their car or sell their car and cut costs. Thus, a company car vs. a car allowance or reimbursement is a no-brainer for an employee. It works in the employee’s favor to have all of their business costs covered and many of their personal travel costs.

On the employer side, the picture is not as clear. Organizations both small and large that provide company vehicles struggle to manage costs. There are the direct costs of acquiring and maintaining a fleet that depreciates over time. There are also the insurance costs and constant risk of employee-involved accidents. Then there are the administrative costs of operating a complex program:

- - Finding vehicles that are attractive, practical, and fuel-efficient

- - Employing an individual or a team to manage program administration

- - Maintaining employee reporting of personal and business use

- - Modifying the personal use chargeback policy to control costs

Outlook for Company Fleets in 2024

Over the past decade, the insurance costs for both medium (20+ vehicles) and large fleets have skyrocketed. On average, commercial insurance premiums have increased an average of 8% per quarter since 2017. While overall accidents are down, the cost per accident has increased sharply, with commercial auto claim severity rising 72% over the past decade.

One of the most significant factors is the increase in distracted driving and costly lawsuits. And around seven years ago, many insurance providers started to reclassify small and mid-size fleets, adjusting their insurance rates upward. On top of it all, the prices of new and used vehicles have skyrocketed, making replacement costs and total loss claims higher than ever.

There’s also the constant risk of employee car accidents. After increases in accidents, many organizations have decided to get out of the risk business. When providing a company car for employees, the company is at risk 24 hours a day, 365 days a year. Even a handful of accidents can increase insurance costs and put a company at risk of being dropped from its insurance provider. Unlike companies that reimburse employees for the use of personal vehicles, companies that supply vehicles face risk even outside of work hours.

With vehicle prices remaining near historic highs and maintenance costs increasing as well, can companies that provide vehicles for employees sustain these compounding cost increases?

How much longer can fleet operators sustain these vehicle cost increases?

Because of rising costs, some organizations will be forced to abandon their company vehicle program whether they want to or not. This could in turn lead to a reordering of expectations within certain industries about employee benefits, ultimately opening doors for more customizable approaches toward business vehicle programs.

CHAPTER :

Auditing Your Company Vehicle Program

When it comes to determining the viability of a company vehicle program, there are two key elements to examine:

- Overall program costs and sustainability compared with program benefits

- Program costs compared to alternative vehicle program approaches

Calculating the costs of a company car

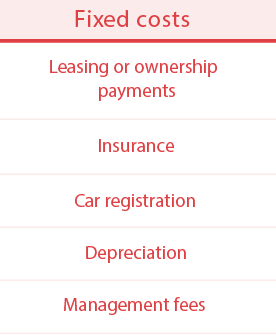

While some of the costs of a company vehicle program are obvious – purchase/lease prices, fuel and maintenance costs, insurance, and taxes – others remain hidden and easy to ignore.

We first recommend categorizing your costs into two categories: fixed and variable.

Once you have established these more obvious costs, it’s time to calculate the “hidden” costs. These less apparent costs could include:

When you add these costs up, you may find they exceed the benefits that the company vehicle provides. This does not mean that you should abandon the program. Instead, it may mean that you need to institute a new set of practices that reduce costs. Or it may lead you to transition some but not all of your fleet program toward a reimbursement approach.

Conducting an annual review of your fleet program

If you decide to focus on retaining and improving your program, we recommend instituting an annual fleet costs review – especially for organizations that have fifteen or more company vehicles. Such a review should include:

Do they match employee productivity, or are you subsidizing personal fuel use?

Can you sustain the increases that have hit so many business and commercial policies over the past few years?

Is your organization subsidizing personal use without realizing it?

There is perhaps no more important step than determining how much employee personal use is costing you and whether you can recoup those costs by establishing or tightening up a personal use chargeback policy. The next chapter will guide you through that process.

CHAPTER :

Company Car Tax Rules and Personal Use

No fleet cost brings more headaches – or opportunities for savings – than your personal use policy. Unfortunately, many organizations underestimate the amount of personal use and its effects on overall company costs.

Although organizations can chargeback personal use of a business vehicle, they tend to fall short of what IRS tax rules require. There are four options for determining personal use.

Determine the percentage of personal miles driven for the year and multiply the annual lease value of the vehicle

How much it would cost for the individual to lease the same vehicle in their geographic region.

Multiply the IRS standard mileage rate (67 cents/mile for 2024) by the number of personal miles driven.

Multiply the commute (e.g., $1.50 one way or $3.00 round trip).

Why is it important to calculate the personal use of a company vehicle?

A company-provided vehicle is considered a fringe benefit or part of an employee’s taxable income. Because the total amount could be regarded as taxable income, it is crucial that you measure the fringe amount and reduce both the employee and company tax liability.

If you can’t determine business versus personal use, the total value of the vehicle is considered to be 100% taxable to both the employee and the employer. Accurate reporting is important to substantiate business and personal use, so neither the employee or the company faces undue tax liability.

Does the IRS classify personal use of a company vehicle as a “de minimis” benefit?

A de minimis benefit is defined by the IRS as an employee benefit that “has so little value … that accounting for it would be unreasonable or administratively impracticable.” The IRS guidance on company vehicles clearly states that any personal use beyond “the commuting use of an employer-provided automobile or other vehicles more than 1 day a month” is excluded from being a de minimis benefit and taxable.

In other words, to comply with company car tax rules, the employer must calculate employees’ personal use using one of the four acceptable methods and charge employees back or withhold taxes on the calculated amount of personal use.

Ways to improve personal use policies

If your organization currently does not carefully calculate personal vs. business use, the administrative headaches that come with it could be worth it to reduce a) the company costs and b) the tax liability for both company and employee.

One vital tool to maintain accurate records of employee business mileage is a state-of-the-art mileage tracking app that integrates seamlessly with your expense system, payroll, and CRM software. By supplying employees with a mobile app that automatically records business vs. personal mileage depending on time and location, you can streamline the personal use chargeback administration and decrease the cost of your company vehicle program.

Another way to reduce personal use is to tighten up company fuel card policies. The amount of driving each month necessary to complete a job is relatively predictable. By limiting the total amount of fuel that can be charged or the days of the week employees can buy fuel, you can help rein in personal use of fuel. Remember, any fuel used for personal trips is taxable.

The complications of administering an effective personal use chargeback program could be a reason to consider transitioning away from operating a company fleet. We'll explore the alternatives next.

CHAPTER :

Benchmarking Your Company Vehicle Program against the Alternatives

Calculating the costs of your fleet program is the hard part. But you also need to compare them against the costs of other business vehicle programs.

None of these programs supply as robust a benefit to employees as a company vehicle. Still, for companies struggling to keep their fleet program sustainable, one of these alternatives might be a better fit.

You will want to benchmark the costs of your company vehicle program against the costs of the following alternatives:

First, let’s take a few minutes to consider the pros and cons of each approach.

Car allowance

A car allowance is a set monthly stipend paid by the company to the employee to offset the use of a personal vehicle for work. For example, a company may pay all of its sales reps a flat car allowance of $600 per month as part of their compensation package.

Pros

- • Simple to understand

- • Easy to administer via payroll

- • Employee assumes vehicle risk and maintenance

Cons

- • Taxable (unless you substantiate business use, a complex procedure)

- • Prone to labor code violations

- • Inequitable results (equal payment for unequal costs)

The prime advantages of a car allowance – simplicity and convenience - create distinct disadvantages. Taxes can take 30-40% off the top. Employees get shortchanged. This constitutes a huge step down for an employee used to receiving the full benefit of a company vehicle. With insufficient payments come labor code violations in states that require full reimbursement of employee expenses. And because different employees face different expense levels based on how much they drive and where they live, a standardized car allowance can overpay some while underpaying others.

Some organizations will try to beef up a car allowance by adding a fuel card or fuel reimbursement on top of it. Not only does this increase costs significantly, but it opens the door to personal use challenges, just like a company vehicle.

Neither a traditional car allowance nor a car allowance plus a fuel card is recommended for a company looking to transition away from a company car program. Instead, the simplicity of the program is its only recommendation.

Mileage reimbursement

Paying a mileage reimbursement using a cents-per-mile rate such as the IRS standard business rate may be a more attractive approach.

Pros

- • Simple to understand and fairly straightforward to administer

- • Non-taxable if the mileage rate does not exceed the IRS rate and the company keeps accurate mileage records

- • Can be cost-effective if combined with an accurate mileage tracking app that separates personal from business use

Cons

- • Low-mileage drivers tend to be under-reimbursed

- • High-mileage drivers tend to be over-reimbursed

- • Drivers may over-report mileage, adding unnecessary costs

Under-reimbursement occurs because low-mileage drivers face similar fixed costs to high-mileage drivers but may not accrue sufficient mileage to offset those costs. In addition, cost-control issues arise when drivers seek to boost their benefits, drive or report extra mileage. Unfortunately, both problems remain hidden and require a certain degree of administrative attentiveness to identify.

Ultimately, a large company with drivers that cover different-sized territories and that operate in regions with large cost differentials will encounter significant inequalities in reimbursements. For example, a low-mileage driver based in an expensive city will not receive a sufficient reimbursement, and a high-mileage driver based in a less expensive, mostly rural territory will be making money at the company’s expense.

Fixed and variable rate reimbursement (FAVR)

While more administratively complex than a car allowance or mileage reimbursement, FAVR provides the best alternative to a company vehicle program. A FAVR reimbursement program combines the concept of a monthly stipend with a mileage rate but delivers non-taxable payments.

Pros

- • Non-taxable payments

- • Will not over-reimburse or under-reimburse (equitable to employees)

- • Suitable for a workforce with diverse expense needs

- • Transparent to employees and defensible to labor codes

- • Scalable (works for 5 employees and for 5000)

- • Responsive to rapidly changing expense needs (fuel price spikes, etc.)

Cons

- • Administratively complex

- • Not initially easy to understand for employees

The key to FAVR reimbursement is to use vehicle expense data for each employee’s zip code to determine both the likely fixed costs and variable costs of that employee. Then, by using a company-determined “standard vehicle” suitable for the employee role, you generate a monthly stipend to pay the fixed costs and an adjustable mileage rate to pay the variable (mileage-based) costs. The employee may drive whatever type of vehicle he or she chooses, but the rates are based on the type of vehicle considered most suitable for the job.

Because of its accuracy, flexibility, and cost-effectiveness, FAVR is our recommended choice for companies that seek to transition away from a company car program.

Choosing the right policy for your organization

Once you have weighed the costs and benefits of your current company car program and compared these with the alternatives, it is time to decide whether to make adjustments to your fleet program administration or to partially or fully transition to a reimbursement model.

If you decide to focus on improving your current program, mBurse can provide you with resources to streamline your personal use chargeback policies and to eliminate the administrative challenges of proper mileage capture.

There is a good chance, however, that there is a bigger opportunity to control costs and risks by moving at least some of your fleet to a professional vehicle reimbursement. The rest of this guide will focus on how to successfully transition to a reimbursement.

CHAPTER :

How to Transition Successfully to a Vehicle Reimbursement

Let’s be honest – it is tough to switch from a company car to a reimbursement. The key is to execute a well-designed plan.

From the employees’ perspective, you are taking away an attractive perk. There may be a group of employees that accepted your offer as a result of a company vehicle being provided. How do you handle an employee who now drives their dream vehicle? Managers will bear the brunt of employee dissatisfaction as they experience what may feel like a pay cut.

Because the potential changes involve risks, emotions, and compensation, it is vital that you have strong leadership and a good plan for change. The transition will save money and reduce risk, but it also involves people. If not properly administered, you will create a distraction at the minimum and the potential for productivity loss and employee attrition at the maximum.

The key is to provide your employees with a transitional option to assist in implementing the new policy.

Steps to create transitional options for a change in a company car policy

Reassess your employees’ company vehicle benefit

Reassessing the vehicle benefit means re-evaluating the perk through the lens of an employee. Take a harder look at your personal use chargeback policy and what it means for employees in reality. What does it mean to be able to take the company car on vacation? What does it mean to an employee to use the company vehicle during personal time?

Employees who have another vehicle at home may have reduced their insurance by classifying that vehicle as a leisure vehicle. Others may not spend a lot on maintenance and tires. If you have a liberal or unmanaged personal use policy, the company car could hold a much more significant benefit to employees than expected. Auditing personal use from the employee's perspective is key to understanding this benefit and its actual cost.

Find out what the competition is offering

What are your competitors providing with regard to their car allowance or reimbursement policies? It is crucial to provide a benefit equal to or greater than the competition to assist with talent attraction and retention.

We recommend surveying competitors and organizations of similar size. (mBurse provides competitor benchmarking reports for free – set up a phone call to get started.)

This extra data point is invaluable. If you switch to a car reimbursement model without equaling or exceeding comparable organizations’ offerings, it makes sense that some employees will pursue a new job. You will also want to use this information to determine whether to assist the drivers in transitioning out of the company-provided vehicle.

Weigh your vehicle program options.

Explore and understand all car allowance and reimbursement options (see chapter 4). Comparing these options to your company car program, what makes the best sense for your company? Determine what is important for your organization. Is it best to provide a car allowance or mileage reimbursement because it is easy?

Here are the most important qualities of an effective car reimbursement policy:

- • Geographically cost-sensitive (cost and mileage)

- • Based on data (accurate and transparent)

- • Fair and equitable to employees while controlling costs

- • Defensible – complies with IRS regulations and state expense indemnification codes

- • Non-taxable – avoids reducing the benefit unnecessarily

Keep quiet until you have a clear plan

Until you have the details ironed out, avoid sharing your plans with the team receiving the company car program. If you mention the elimination or restructuring of the current program without a solid new option, it will create distraction, distrust, and disdain.

The number one thing employees will want to know, “How much will I get?” Until you have a solid answer, we recommend not bringing them into the conversation. Sharing the “bad” news without any details will generate anxiety and take the focus off of getting their job done.

Budget both time and money for the transition

Budgeting for change doesn’t stop at evaluating costs; it also means allotting enough time for employees to prepare for and adapt to the change. What if they do not currently have a personal vehicle or don’t have one suitable to get the job done? You do not want them scrambling to adjust to an unexpected policy change. That will ruin trust and send valued people out the door.

At a minimum, we recommend a four-to-six-month adjustment period before the new program goes into effect. You also need to budget time to evaluate the new car allowance or reimbursement when it is instituted and make adjustments as needed.

Provide transitional options to employees

The most important step to take involves exploring transitional options. You will maintain trust and goodwill if you offer an interim benefit that helps employees transition as smoothly as possible. These options should be part of the initial announcement of the change.

Transitional options might include:

- • Selling the company-owned vehicle to the employee at a significantly reduced cost

- • For a company-leased vehicle, offering a lease buyout and purchase

- • Providing down payment assistance for a new vehicle

- • Providing a transitional bonus

The first two options only work if the employee is interested in keeping the company vehicle or if the employee gets a robust deal. Down payment assistance is the more popular transition option, giving the employee maximum freedom to procure a desirable vehicle that is also suitable for the job.

mBurse can offer customized transitional solutions as well as professional vehicle reimbursement policies and tools to help mitigate the costs and challenges of tightening up your company car policy to a transition by attrition that makes sense for your organization.

CHAPTER :

Conclusion:

How to Get Started

Depending on your organization’s circumstances and goals, there are many routes you could take to introduce a more cost-effective company vehicle program.

Keep the company car but adopt cost-effective policies

If it does not make sense at this time to transition away from a company-provided vehicle, you can still cut costs by auditing your personal use policy, your company fuel card use, and your employee mileage tracking.

The transition from a company car to a car reimbursement

If it makes more sense to take the bigger step of adopting a new vehicle program, we recommend that you follow the steps recommended in this guide:

Recommended steps

These steps are not easy to take. If you would like a professional to guide you in the process, schedule a call with mBurse today, and one of our consultants will help you get started.

Whatever route you take, don’t hold back because change seems intimidating. The fact is, company vehicle programs are getting more and more expensive to maintain. Market forces will likely push you and your competitors to shift toward new vehicle policies and practices in the future. The sooner you act, the more control you will have over the situation