Many organizations attempt to address the fact that auto allowances alone after taxes will not be adequate in covering mobile employees costs of operating their vehicle. When a company takes their auto allowance in house to find a solution we refer to it as a Hybrid or In-house/Home Grown reimbursement policy. Hybrid reimbursement policies are auto allowances with:

1. A fuel reimbursement or fuel card

OR

2. A mileage reimbursement rate

What these organizations don't realize is that they are making increasing or compounding the problem. While it may seem like an ideal solution you are just throwing money at the problem which unnecessarily increases your organizations costs while contributing to the over and under reimbursement of your mobile employees.

If you are providing an fuel card or fuel reimbursement:

There are several common issues with “home grown” auto allowance and reimbursements you may experience but not notice. Your organization may:

It’s time to stop the slow leak of money caused by programs like this. Consider our solutions here.

One of the oldest classic reimbursement programs for mobile employees is providing a flat per-mile rate for reported business mileage. It is implemented based on ease of use and understanding, mobile employees are reimbursed based on mileage.

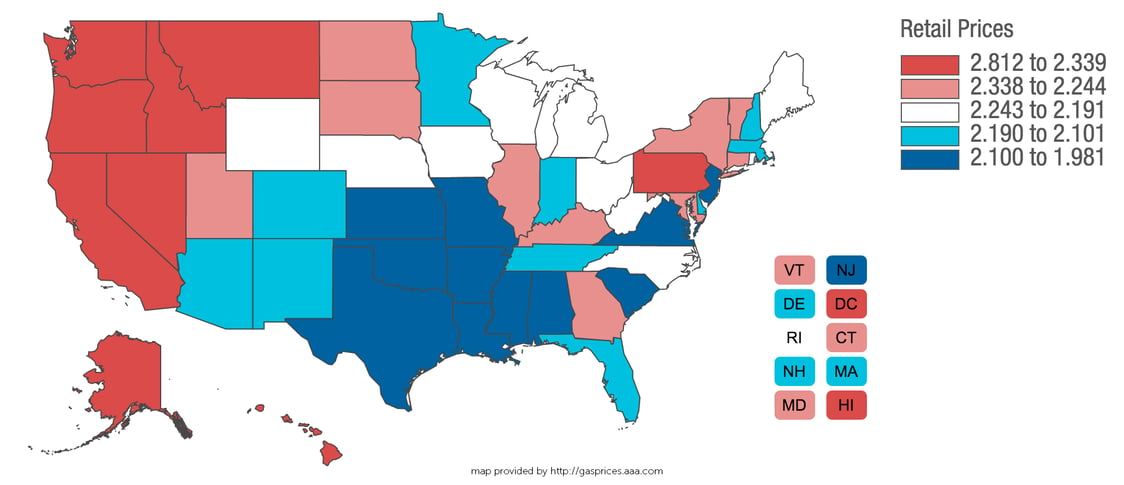

Many organizations utilize the IRS rate, a tax tool, for reimbursing their mobile employees. The IRS rate is very inaccurate utilizing last years average costs to determine this years rate. By utilizing historical costs as opposed to actual costs the IRS rate inaccuracies will contribute to over-reimbursing high mileage mobile employees and under-reimbursing lower mileage mobile employees.

Some challenges with this classic program that you may experience but notice:

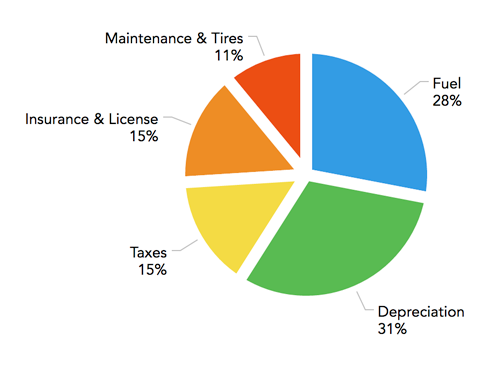

The flat taxable car allowance is one of the most common methods of vehicle reimbursement. Companies typically pay a set amount to all employees as it is simple and easy to administer; to offset driving costs. This is also one of the most costly methods of delivering dollars to your mobile employees because it creates an unnecessary tax burden on your employees and your company. Every employee receives the same amount, even though they experience different costs to operate their vehicles (fuel, insurance, maintenance, taxes and registration). This is not an equitable program.

Here are some issues with this classic program that you may experience but not notice:

All of these issues can lead to employees driving less to manage their costs, its time to remove the unnecessary tax waste.

1660 South Albion Street

Suite 318

Denver, CO 80222

(303) 357-2550

(888) 658-2982

© 2025, all rights reserved.