The 2025 mileage rate is $.70/mile

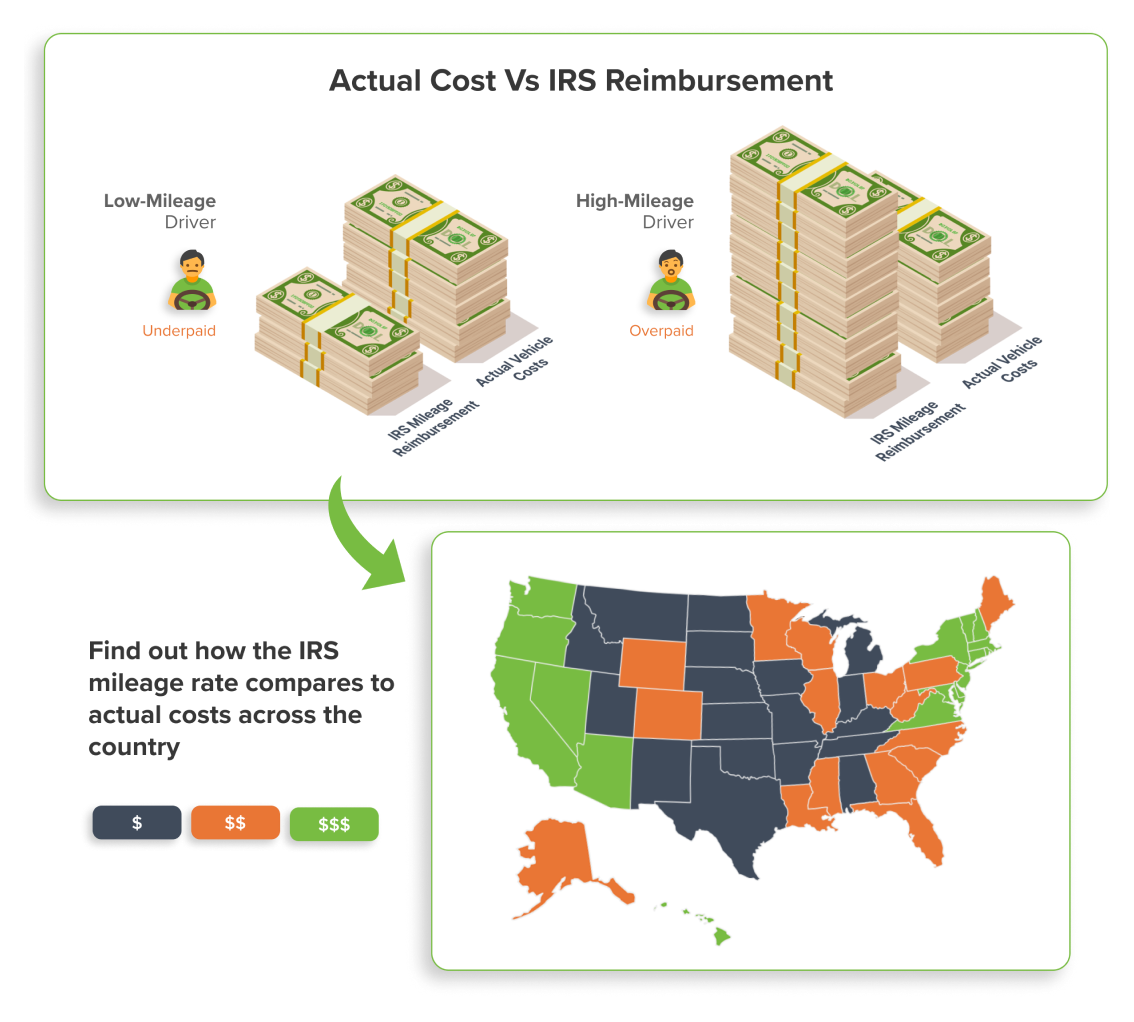

Is the IRS mileage rate the best option?

Reimbursing employees, the government mileage rate is simple but comes with a price:

- Over-reimburses high mileage drivers up to 51% of their actual expenses.

- Under reimburses lower mileage employees 41% less than their actual expenses.

- In most states, you are not obligated to pay the IRS mileage.

mBurse's benchmarking report will help you address these unique challenges.

Complete the form to receive your complimentary report.

Trusted by over 1,000 Businesses

The IRS mileage rate inaccurately reimburses your employees

Employees experience different out-of-pocket expenses based on where they live and drive.

Providing one mileage rate to cover employees' costs accurately is tough.

Benchmarking Report Benefits

Accurate Reimbursements

Ensure you are paying the right reimbursement rate. All the time

.png?width=100&height=100&name=Frame%20270990220%20(1).png)

Control Costs

Maximize your cost efficiencies while staying within your budget

Fairness for All

Provide a fair reimbursement regardless of the mileage driven

An Accurate Approach

Vehicle reimbursements are conceptually simple but have become increasingly complex:

- Employees experiencing different geographic costs

- Staying on top of tax code changes

- Employees who drive different amounts of mileage

- Keeping up with increasing costs (insurance & gas prices)

About mBurse

For over 16 years, mBurse has provided fully managed vehicle reimbursement programs. Our data and services support your mobile employees.

Visit mburse.com or connect with us on X or LinkedIn.