2025 Benchmarking Report

How much is a fair car allowance?

Most organizations, though well-intentioned, don't pay the correct vehicle allowance. Did you know that:

- 86% of organizations pay too much or too little for their program

- 91% of employees said the vehicle allowance influences whether they accept or keep a job

- 73% of organizations don't utilize data when calculating their rate

Use our vehicle cost data to determine if your auto allowance keeps pace with your employee's expenses.

Complete the form to receive your complimentary report.

Trusted by over 1,000 Businesses

Take the guesswork out of your car allowance

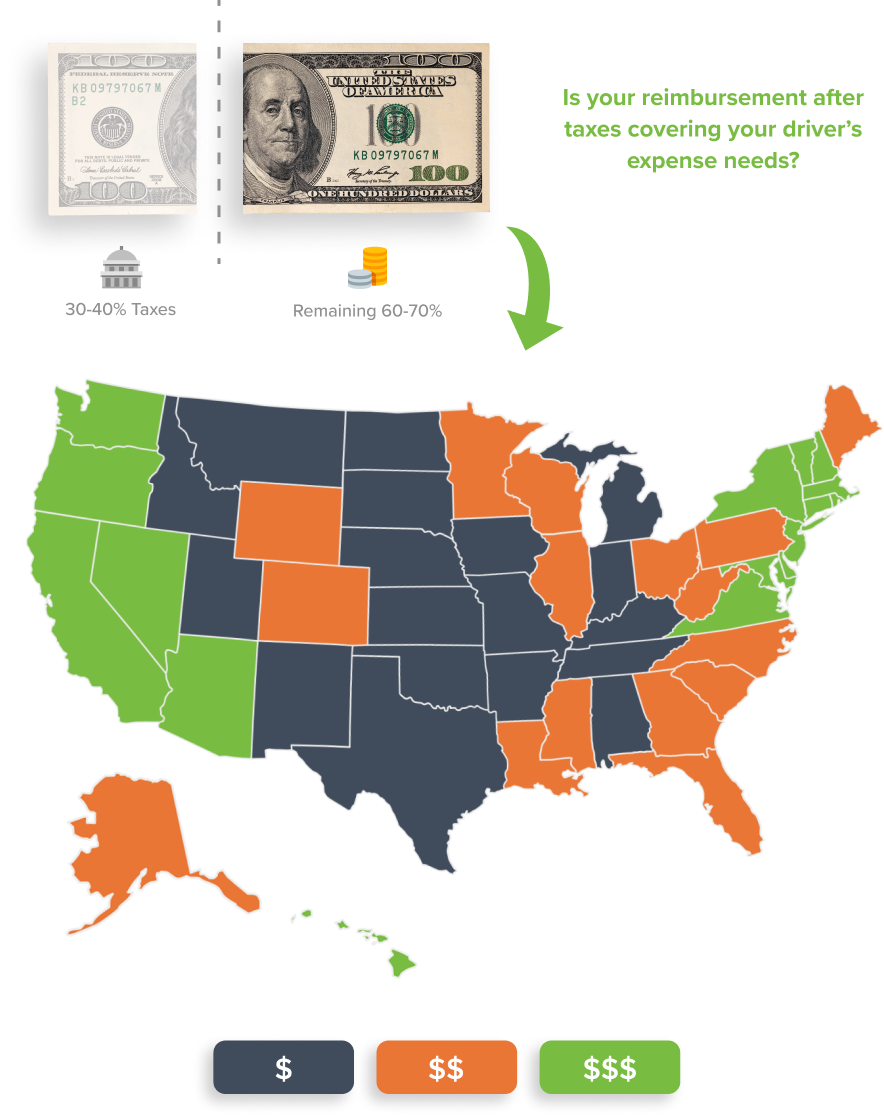

Make sure employees' after-tax car stipend offsets their out-of-pocket expenses.

Employees experience different geographical costs for insurance, personal property taxes, and fuel costs based on where they live and drive.

Benchmarking Report Benefits

Attract & Retain Talent

Make sure your rate is competitive in the marketplace

.png?width=100&height=100&name=Frame%20270990220%20(1).png)

Sanity Check Your Spend

Maximize efficiency and budget-friendly friendliness

.png?width=100&height=100&name=Frame%20270990220%20(2).png)

Ensure Compliance

Receive a roadmap to keep you safe from labor code and IRS audits

Right-Sizing Your Program

Vehicle allowances are conceptually simple but have become increasingly complex:

- Employees experiencing different geographic costs

- Staying on top of tax code changes

- Employees who drive different amounts of mileage

- Keeping up with increasing costs (insurance & gas prices)

About mBurse

For over 16 years, mBurse has provided fully managed vehicle reimbursement programs. Our data and services support your mobile employees.

Visit mburse.com or connect with us on X or LinkedIn.