Everything your business needs know about mileage tracking.

Our guide to cost-effective, IRS-compliant mileage logs and tracker apps

It is a 9 minute read

It is a 9 minute read

Tracking Mileage for Business

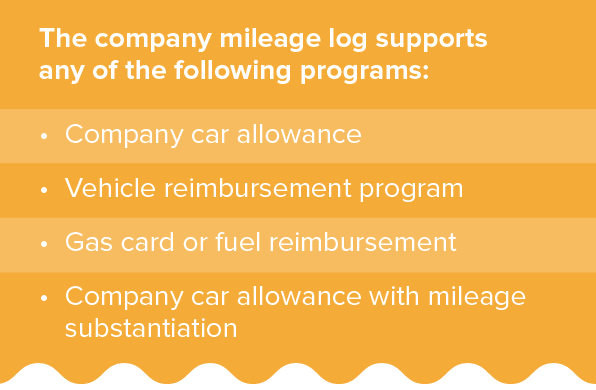

If your organization employs people whose jobs require a vehicle, there’s a good chance you operate a system to calculate and report their business mileage. Businesses have recorded employees’ mileage for a long time and for a number of reasons:

- To substantiate business mileage for tax deductions

- To keep employee car allowances tax free

- To substantiate business use of a company-issued vehicle

- To reimburse employees using a cents-per-mile rate

- To reimburse employees for fuel or substantiate a fuel card

As America’s workforce has turned increasingly mobile and technologically has advanced, mileage logs have taken increasingly diverse forms. What do they all have in common? Simply put, a mileage log is any tool that can be used to store such data as trip date, business purpose, origin, destination, and miles driven.

All of the following have at one time or another served as mileage logs:

- Paper mileage booklets

- Microsoft Excel spreadsheets

- Expense systems

- Expense systems with Google Maps integration

- GPS-based mobile apps

Each form has come with its advantages and disadvantages, and each remains an option for companies today. But when considering a) whether to track mileage, and b) how to track mileage, it’s important to understand why mileage tracking is important, and how the choice of a mileage log can impact an organization on multiple levels.

Let’s start with why tracking mileage is important.

CHAPTER :

Why you need a mileage log in the first place

IRS-compliant mileage logs are a necessity for organizations with employees whose job responsibilities require a vehicle.

Tracking mileage substantiates the business use of a vehicle to avoid taxing employees and to allow the company to write off reimbursements as a business expense.

In other words, if you want to provide a tax-free reimbursement, you have to record employees’ business mileage – unless you want to track every single car expense.

Mileage tracking for IRS-accountable reimbursements

When it comes to offsetting employees’ business expenses, the IRS distinguishes between accountable plans (tax-free reimbursement) and non-accountable plans (taxable compensation).

In order to meet the criteria for an IRS-accountable plan, you must prove that all payments to an employee – whether a monthly car allowance, a mileage reimbursement rate, or a fuel card – constitute reimbursement for business expenses, and not compensation.

To prove these payments are reimbursements, you have to show that the payments do not exceed the business expenses incurred by the employee while operating a vehicle.

An IRS-compliant mileage log is the only way to prove this without resorting to the tedious process of tracking each employee’s individual expenses.

Scenario: Is this mileage log IRS-compliant?

A company that provides a gas card or gas reimbursement for personal vehicles or company cars must calculate and record the business mileage. Otherwise, there is no way to determine how much fuel was used for business purposes and how much was used for personal reasons. Without business mileage tracking, the gas is considered personal use, making the expenditure taxable for both employer and employee.

Let’s say you do keep track of mileage, but employees report it from their own records every few months, rather than using a company mileage log. In this case, your plan would still be considered a non-accountable plan under IRS rules.

What are the IRS requirements for a mileage log?

To maintain an accountable plan with an IRS-compliant mileage log, keep in mind the following:

- The mileage log must be up-to-date. The IRS requires that mileage be recorded within a reasonable amount of time after a trip has occurred. This means you cannot calculate mileage 4-6 months after a business trip.

- Contemporaneous mileage tracking is best practice. In other words, you should record the mileage the same day that the trip occurs. At the very least, the IRS mandates that mileage logs be less than 3 months old.

- You keep the records, not the employee. The IRS designates the employer, not the employee, as the custodian of record. Because the employer is paying the fuel costs or reimbursing the mileage, the employer assumes responsibility for the record-keeping. Remember that the employer is using the mileage log for tax deduction purposes.

- Maintain a mileage archive. The IRS requires a company to keep mileage records for five tax years after filing a tax deduction based on business mileage.

CHAPTER :

Choosing the best mileage tracker for your business

The form your company’s mileage log takes can impact several different aspects of the organization beyond taxation:

- Cost control

- Employee productivity

- Administrative efficiency

- Attrition rates

- Employee privacy

- CRM adoption by employees

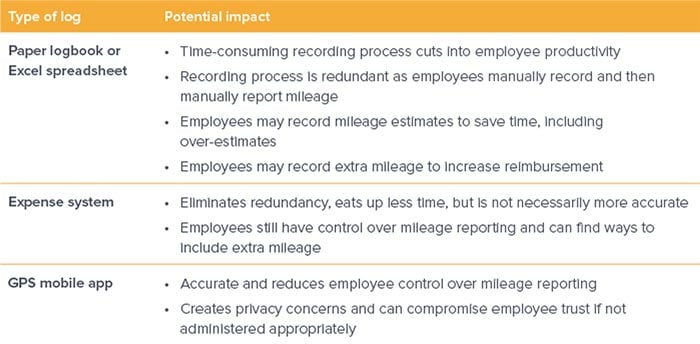

The type of mileage log available has always depended on current technology. Originally, mileage logs were paper books to store entries that included date, business purpose, origin, destination, odometer readings, and miles driven.

In the mid-to-late 1980s, computers revolutionized the mileage log book. Many organizations began storing mileage in spreadsheets like Microsoft Excel. Recording mileage remained time-consuming because it still involved keeping a separate log and inputting data each week or month into the spreadsheet. However, spreadsheets added convenience by automating the arithmetic and allowing electronic record-keeping.

However, spreadsheets added convenience by automating the arithmetic and allowing electronic record-keeping.

In the early 2000s companies adopted new software to track and reimburse expenses. Some of these

Integration accelerated in the 2010s as mobile apps emerged to store and calculate mileage. Some of these apps continue to rely on Google Maps and manual inputs, but others use GPS tracking to automatically calculate and record mileage. All the driver has to do is press “Play” on a smartphone or tablet.

Many companies have yet to adopt these integrated mileage platforms. This matters. A lot. To understand why, let’s look at each of the available mileage capture methods and consider their possible impacts on an organization.

The older methods involve redundant, time-consuming administrative tasks and create loopholes that make it nearly impossible to control costs. However, many organizations have been slow to adopt more efficient mileage capture systems. Employees don’t like to be tracked or feel that “Big Brother” is watching. Their employers have worked hard to build trust and are hesitant to sacrifice trust for higher cost control.

No approach has achieved perfection, but when you consider the consequences of sticking with older processes that involve self-reported mileage, you find that concerns with the latest technology pale in comparison.

Curious? Try a demo or 30-day free trial of a mileage tracker.

CHAPTER :

How to properly log business mileage (Goodbye, Excel spreadsheets!)

For decades, nearly all mileage logs relied on self-reported mileage (manual entry and calculation). While self-reporting can take many forms, no form can eliminate the costly problems inherent to self-reporting.

The most common form of self-reported mileage is the spreadsheet. It's easy to use Microsoft Excel to create a spreadsheet that calculates mileage once you enter the trip information. However, the spreadsheet mileage log is a deeply flawed approach.

Self-reported mileage logs are subject to human error

Accuracy is necessary for effective mileage capture. But self-reported mileage relies on humans who are prone to error and may not always act honestly.

You can switch from a paper logbook to an Excel spreadsheet, but you’re still relying on human beings to input accurate trip data in the first place. You can reduce redundancy and opportunity for errors by using an integrated expense system, but as long as the calculations rely on human-provided data, there’s still room for mistakes and dishonesty.

Self-reported mileage logs are subject to costly shortcuts

Let’s face it – mobile employees are tasked with a wide variety of time-consuming responsibilities. As rational beings, they will look for shortcuts. We all do this.

Their tasks may include keeping up with internal reports, CRMs, and more. When employees are tasked with calculating business mileage, costly shortcuts occur.

They may estimate or guess mileage. They may even buffer their mileage, especially if their reimbursement rate isn’t keeping up with their expenses. (Try checking their productivity against their mileage. If the latter rises but not the former, that could be an indicator of buffering.)

If an employee makes an error with their mileage, the error will likely be in their favor. Even small errors or slight over-estimates can add up over time across a large organization.

Self-reported mileage logs are nearly impossible to audit

When employees self-report, it’s very difficult to test their accuracy. How do you catch errors in mileage inputs or discern whether a trip occurred in the first place? Can you afford to task management with this level of time-consuming oversight?

Many organizations find themselves at the mercy of employees *

Self-reported mileage logs demand unproductive employee time

Paper logbooks and Excel spreadsheets obviously require significant non-revenue generating time. But even expense systems do not fully solve this problem.

But even expense systems do not fully solve this problem.

Employees must carry out many of the following steps:

- Keep a log of trips for the month

- Calculate mileage for the trips

- Enter the information into the spreadsheet or expense system

- Submit the mileage for approval

- Have the mileage approved

- Correct any errors that are caught during mileage approval and resubmit

This is an inefficient process and leaves the door open to human error.

Google Maps cannot fix the spreadsheet mileage log problem.

Even if mobile workers utilize Google Maps or MapQuest to determine trip distance, accuracy can still suffer, and inefficiency can still result.

Mapping tools look for the shortest time between point A and point B. However, interstate travel can make a longer route the fastest.

And what if an employee takes an alternative route because of traffic, construction, or weather? They are left to add mileage to make up the difference between the actual route and the Google Maps calculated mileage. Or they must undertake the time-consuming process of creating a customized route in Google Maps.

True, utilizing mapping software takes less time and delivers higher accuracy than other manual forms of calculating mileage, but it cannot fully solve the problems inherent to self-reported mileage.

CHAPTER :

Mileage tracker apps and employee privacy

Nearly everyone has used GPS to navigate on a trip, whether with a Garmin device or an iPhone app. The Global Positioning System has become a part of everyday life, and it’s quickly becoming the most accurate and efficient way to record mileage.

GPS devices communicate with a network of satellites to pinpoint the device’s geographic location. The Department of Defense began developing what would become the GPS system in the 1960s to improve navigation and to track nuclear submarines.

In the 1980s, the airline industry became the first commercial users of GPS. By the 2000s, the shipping industry had adopted GPS to track packages. And now nearly everyone uses GPS to get around. That means nearly everyone can be tracked as they go about their business. And there’s the rub. Who wants to be tracked like a FedEx package or a nuclear sub?

GPS mileage tracking: effectiveness vs. privacy

There’s no way around it: GPS mileage tracking is the most convenient and low-cost option for mileage capture. There’s no easier way to comply with the IRS mandate of “fresh” mileage logs. When it comes to calculating mileage, there is no better substitute

Plus, GPS mileage tracking leverages existing hardware. Mobile employees all use a mobile phone or tablet already, so why not employ these tools to track mileage and eliminate self-reporting?

Edward Snowden. The NSA. Facebook. Big Brother. People living in the 21st century face an unprecedented awareness of ways they can be monitored by powerful organizations. No one wants their boss added to that list. Or do they?

How real employees feel about GPS tracking

An independent survey conducted by TSheets in 2016 found that only 5% of workers who had been tracked by employers using a GPS system had a negative experience. In fact, 54% had a positive view, with the rest feeling neutral.

In 2019, mBurse surveyed mobile workers about GPS tracking and found that 81% would support their employer tracking their business mileage if it meant receiving full reimbursement of vehicle expenses.

Overall, while some employees express concerns about micromanagement and being tracked after hours, those who have been tracked find those concerns largely alleviated. Privacy concerns tend to dissipate if an employer uses GPS tracking in ways that clearly protect employees’ privacy and that don’t lead to micromanagement.

Best practices for mileage tracking apps

In order to realize the benefits of GPS mileage logs without driving employees out the door, it’s important to choose an appropriate GPS app and institute guidelines for appropriate use.

1. Choose a GPS app that delivers only business mileage data to the employers.

Drivers should be able to edit trips and designate certain portions as personal so that no data about these trips will be sent to the employer. Our GPS app mLog, for example, never shares real-time location data with employers, allowing users to designate personal mileage before data is submitted for reimbursement. Drivers should also be able to turn off the app if necessary.

2. Set clear boundaries for acceptable use of business mileage data.

Just because you have data on your employees’ whereabouts during business travel doesn’t mean you have to have a conversation about every detail. The primary purpose of the GPS app is to provide accurate mileage tracking for reimbursement and tax purposes.

Using a GPS app can boost productivity simply by providing greater visibility of work habits. It is standard for most organizations to monitor employees’ usage of the internet on company devices. The simple fact of monitoring discourages unproductive internet use without any micromanagement.

It’s all about how you use the data.

CHAPTER :

CRM mileage logs: Another way to leverage existing software

An additional benefit of using a mobile app to log mileage is integration with existing CRM software. Historically, mobile employees have been slow to adopt Customer Relationship Management (CRM) tools like Salesforce.com, Oracle, and Netsuite.

CRM's generate indispensable data, revealing what’s working and what isn’t. Unfortunately, many employees treat these powerful tools as mere electronic Rolodexes.

CRM's generate indispensable data, revealing what’s working and what isn’t. Unfortunately, many employees treat these powerful tools as mere electronic Rolodexes.

In many successful organizations, the CRM is a central hub for sales and client relations. Low adoption of the CRM impacts the entire organization. When properly utilized the CRM can

- reveal effective and ineffective sales practices

- provide helpful data for account management

- facilitate making future projections

- equip management to coach underperforming reps

Smart companies figure out how to ensure total CRM utilization. Their secret? Integrating CRM with existing tools that 100% of employees already use.

Mobile employees all carry mobile phones. Most log business mileage. The latest mobile apps track mileage using GPS while integrating with CRM software and automatically feeding trip data into the CRM.

Employees see the value of being reimbursed for the business use of their personal vehicle. Tying their reimbursement to the use of a mobile app that integrates with the company’s CRM will produce 100% adoption.

CHAPTER :

New GPS advances – the next step in business mileage tracking

GPS offers an incredible tool for mileage capture. But users may still experience some drawbacks. The next generation of GPS satellites, known collectively as GPS III, will bring a new level of precision and effectiveness.

Because GPS devices must communicate with satellites, large structures can block signals and weaken performance. Cities with tall buildings can effectively become “urban canyons.” Similarly, rural valleys can limit the effectiveness of GPS as mountains and hills block signals.

The GPS system essentially consists of three components:

- Satellites in orbit

- Ground control (receiver, antenna, and transmitter to relay signal)

- Signal receivers (Cell phones or other GPS-enabled devices)

In recent years, we’ve seen rapid improvements to ground control and signal receivers. But the existing constellation of 31 satellites have not kept up with the ground technology. Many of these satellites have aged long past their 7.5-year design-life.

GPS III and business mileage reporting

The U.S. Air Force contracted with Lockheed Martin to develop GPS III as a new satellite design that will revolutionize the use of GPS tools. With more powerful signals, an expanded navigational payload, and a 15-year life expectancy, GPS III will improve accuracy while extending the satellites' orbit life.

GPS III’s signals will triple the current accuracy. The U.S. government is in the process of adding new civilian signals to the existing civilian signal. Most notably, signals L1C and L2C will reduce the “urban canyon” effect and the blocking effect of mountains and hills.

Some of the new satellites have been launched already, and all ten should be operational by 2023.

With GPS III on the horizon, now is a great time to switch to a GPS mileage log and leverage this increasingly powerful technology.

CONCLUSION :

Conclusion: Mileage logs are worth getting right

While most organizations have long since left paper mileage logs behind, Microsoft Excel spreadsheets remain the norm for many. Spreadsheets are easy and require no research or training.

But is the status quo worth the hours of unproductive time and uncontrollable costs? The tools exist to revolutionize mileage capture. Consider the benefits of using a mobile app mileage log from the employee’s point of view:

- No more tedious compiling and reporting of mileage

- No more looking up mileage using Google Maps

- Convenient integration and automation of mileage capture and reimbursement

- Confidence that no one will second-guess recorded mileage

- Greater cost control

- Increased productivity

- More efficient reimbursement process

- Improved CRM adoption

In the 21st century, you need a 21st-century mileage log. Take the time to explore your options.

New apps are being created on a regular basis. Technology continues to progress. Increasing numbers of organizations are switching to mileage apps.